A Strong Start to the Year, But Risks Remain

January marked a strong turn-around from December’s lows.

Stocks rebounded strongly in the first quarter, thanks to improving U.S.-China trade relations, the Federal Reserve’s announced pause in rate increases, and an improving outlook for corporate earnings.

The market’s performance during the first quarter was welcome following the volatility and jitters of Q4 2018. We see meaningful improvement in the macro-economic outlook for markets, but notable risks remain. We are prepared for more volatility within the context of an abiding, multi-year bull market. Read on for more detail.

1st Quarter Performance Review

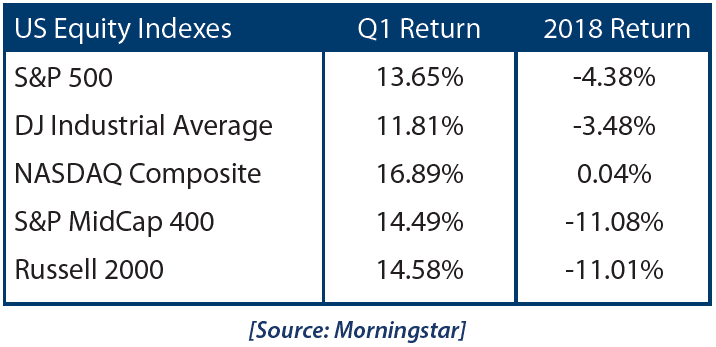

The S&P 500 logged its best quarter since 2009.

The strong market performance that we enjoyed in Q1 had its roots in the Q4 earnings season, when results came in better than many analysts had feared. The market had been primed to overreact to disappointing news, but ultimately did not. More than 70% of S&P 500 companies beat estimates, while over 60% of companies reported stronger than expected revenues. According to the research firm FactSet, S&P 500 companies saw the best stock price reaction to negative earnings per share surprises in nine years. This led to improved confidence, and supported the rebound that we enjoyed in Q1.

Small-cap equities outperformed large caps, due to the reduction in global trade tensions and the Federal Reserve’s announced pause in rate increases. From a style standpoint, Growth outperformed Value.

All 11 S&P 500 Index sectors turned in positive returns; Technology and Real Estate were notable out-performers. Tech was driven higher by the improving trade outlook, while Real Estate benefited from declines in mortgage and interest rates.

Historically defensive sectors underperformed, but still finished in positive territory. Consumer Staples, Healthcare and Financials lagged the S&P 500, as investors rotated toward Growth sectors.

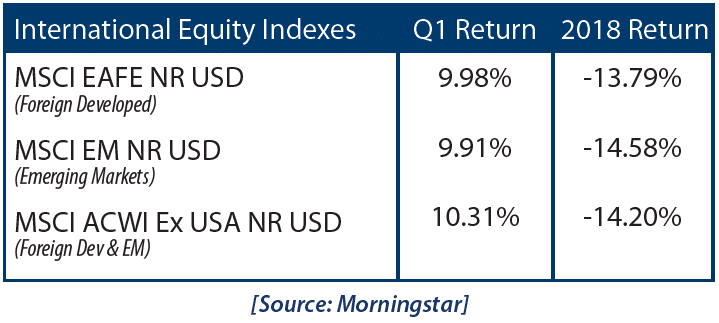

Foreign equity markets also started the year strongly, aided by the European Central Bank’s stimulus announcement. Emerging markets lagged behind, more heavily impacted by U.S.-China trade negotiations and a stronger U.S. dollar.

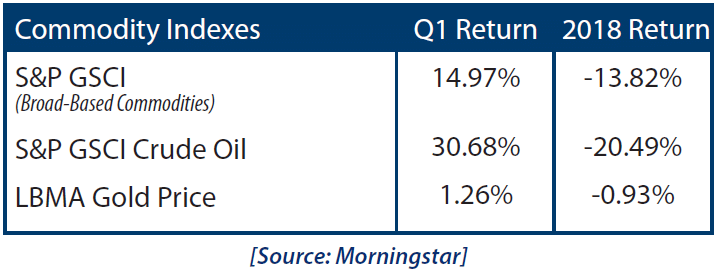

Oil rose sharply, largely due to supply issues such as the Iranian sanction waivers, Venezuelan sanctions that reduce U.S. imports, and a pledge by OPEC to extend production cuts through 2019. Gold logged modest gains, thanks to headwinds from a stronger U.S. dollar, and modest inflation.

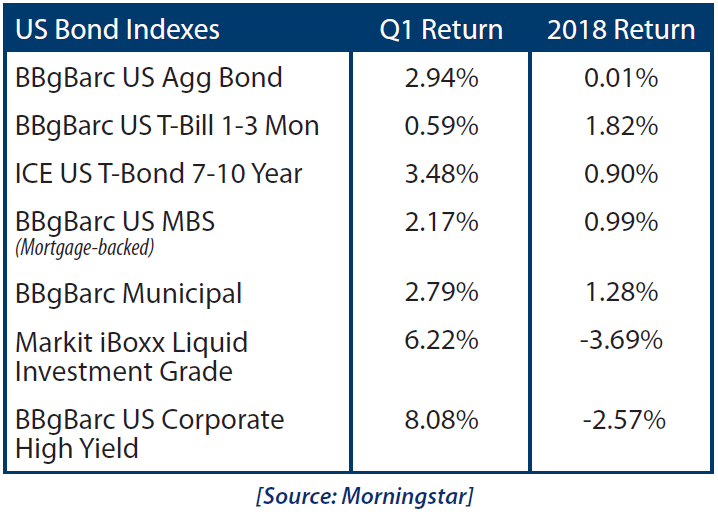

The leading benchmark for bonds logged positive returns, but bond indices lagged stocks. Longer-duration bonds outperformed as expected, in light of the Fed’s pledge not to raise rates again this year.

High-yield as well as investment-grade corporate bonds outperformed government bonds. Corporate bond funds turned in their best returns in years.

Market Outlook

The outlook for markets has improved since the depths of the 4th-quarter correction.

Problems that contributed to 2018’s year-end volatility, including disappointing economic growth, underwhelming earnings results, and confusion regarding future Fed policy are still with us, but have all moved toward clarification.

We continue to see a gradual softening of global positive momentum. European and Chinese manufacturing data has shown actual contraction in some areas. The U.K.’s struggles with Brexit are certainly a present headwind on their economy, and will remain so until the matter is resolved.

Perhaps the most impactful event of Q1 was the January Fed meeting. The FOMC opted to hold interest rates steady, and stated that it would be “patient” regarding further rate increases. This shift, in response to global economic uncertainty, helped extend the markets’ gains from early January. Official projections currently show no more rate hikes this year.

As of this writing, portions of the yield curve have inverted (Treasury yields higher on short-term debt than on long-term). While not conclusive in itself, this dynamic has sometimes preceded slower growth and lower inflation—neither of which are positive for stocks.

We enter the second quarter of 2019 thankful for the strong start to the year, but mindful that now is not a time to become complacent. We’ll review and analyze any trade deal to see if it is the economic positive investors expect.

We are alert for signs that global growth has stabilized and inflected higher. We’ll seek out further clarity on the Fed’s plans for interest rates. Steady rates generally relieve pressure on the economy, and this appears to be happening.

Even if volatility returns, a long-term approach combined with a well-designed and well-executed investment strategy can overcome periods of heightened volatility, market corrections, and even bear markets.

At Krilogy, we understand that volatility can be both unnerving and stressful, and we thank you for your confidence and trust. Rest assured that our entire team will remain committed to helping you navigate this challenging investment environment.

Please do not hesitate to contact us with any questions, comments, or to schedule a portfolio review.

Important Disclosures:

Investment Advisory Services offered through Krilogy Financial®, an SEC Registered Investment Advisor. Please review all prospectuses and Krilogy Financial®’s Form ADV 2A carefully prior to investing. This is neither an offer to sell nor a solicitation of an offer to buy the securities described herein. An offering is made only by a prospectus to individuals who meet minimum suitability requirements.

All expressions of opinion are subject to change. This information is distributed for educational purposes only, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Diversification does not eliminate the risk of market loss. Investments involve risk and unless otherwise stated, are not guaranteed. Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. Investment risks include loss of principal and fluctuating value. There is no guarantee an investing strategy will be successful. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

Services and products offered through Krilogy Financial® are not insured and may lose value. Be sure to first consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.