1. Roth IRA conversions

Pre-tax retirement accounts are a ticking time bomb, because their future tax liability grows every single year. Having a Roth IRA conversion strategy in place can help mitigate this future tax burden. Roth conversions can be advantageous in multiple ways, such as tax-free growth including earnings, and elimination of future required minimum distribution (RMDs). Krilogy Tax recommends having a conversation with your wealth and tax advisors to access the strategic value of a Roth conversion.

2. 529 contributions

A 529 plan is a tax-advantaged savings plan designed to help pay for education. The benefits on state taxes vary by state; Missouri allows a deduction for this year up to $8,000 per person, or $16,000 for married filing jointly. Saving on a 2020 Missouri return equals $864 when $16,000 is contributed. Earnings generated in the account are tax-free if used on future qualified education expenses. The SECURE Act of 2019 adjusted 529 rules to allow payments for K-12 tuition. Before taking advantage of this change, savers should determine whether their state has gone along with the change. Some, such as Illinois, have not. The Missouri 529 contribution deadline is December 31st.1

3. Itemized deduction ‘bunching’ strategy

The Tax Cuts and Jobs Act of 2017 eliminated personal exemptions and nearly doubled the standard deduction. As a result, many taxpayers are using standard and itemized deductions differently now. One advantageous multi-year strategy involves ‘bunching’ deductions into larger, itemized deductions in a single year. In alternate years, the standard deduction is taken. A ‘bunching’ strategy is personalized for each taxpayer, and an option to consider. A great tax-friendly tool to help facilitate charitable contributions is the Donor Advised fund, discussed below.

4. Tax-friendly charitable giving strategy

There are a number of charitable giving options to consider in light of the new tax laws. In recent years, we’ve seen Donor Advised Funds (DAF) grow in popularity as a tax-beneficial and efficient way for clients to execute their ongoing charitable giving. A DAF allows for the tax-free transfer of assets into an account earmarked for charity. They’ve become even more beneficial with recent tax law changes, as donors consider their long-term giving strategy. Similar to deduction bunching above, funds representing several years’ worth of charitable contributions may be transferred into a DAF to help exceed the standard deduction. The write-off is taken in the year the assets are transferred, and all growth in the account is tax-free. Additionally, if required minimum distributions (RMDs) are required from IRA accounts, a qualified charitable distribution (QCD) allows direct transfer of RMD funds, tax-free, to a charity of choice.

NOTE 1: Don’t throw away charitable donation acknowledgment letters, yet! The SECURE Act added an above-the-line deduction for charitable contributions up to $300 for individuals who do not itemize in 2020. This added deduction does not have an income threshold.

NOTE 2: The CARES Act increased the limit on the deduction for monetary charitable contributions from 50% to 100% of adjusted gross income (AGI) for 2020, only.

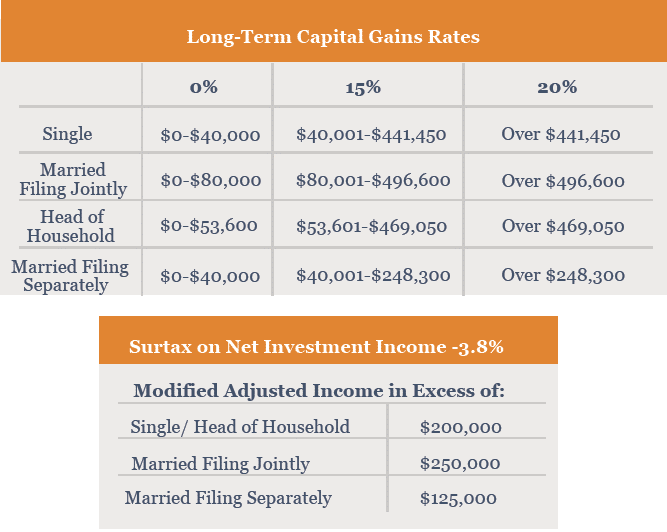

5. Timing the sale of investments

For taxpayers whose income tends to fluctuate from year to year, and taxpayers close to the higher capital gain bracket thresholds, it is wise to assess the tax impact on the sale of investments. It might be better to hold onto a capital asset at year-end to avoid higher capital gains brackets, especially if a lower income tax bracket is possible in 2021. Also, the net investment income tax (NIIT) needs to be taken into account, which is a 3.8% tax on top of the capital gains tax.

Refer to the charts below.

6. Required minimum distribution (RMD)

The SECURE Act made significant changes to the required minimum distribution (RMD) rules2.Taxpayers not needing or wanting their RMD, may consider a qualified charitable distribution (QCD), or contributing to a grandchild’s 529 college savings account, as tax-advantaged alternatives.

Taxpayers may not be certain they are on track with what the IRS requires to be distributed by December 31. To double check, and discuss alternative RMD strategies, reach out to your advisor for guidance.

7. HSA contribution

Taxpayers in an eligible high-deductible health plan can contribute to a Health Savings Account and receive a tax deduction. Contribution limits for 2020 are generous: $3,550 for single coverage and $7,100 for family coverage plus an additional $1,000 if over age 55. HSA contributions lower your taxable income, as they are made pre-tax through payroll. In addition, earnings from interest and investments grow tax-free, distributions for qualified medical expenses are tax-free, and any unused balance automatically rolls over each year until used. It is not too late for 2020: HSA contributions can be made up until the taxpayer’s filing date, without extension. Once funds have been contributed, they can be withdrawn as reimbursement for 2020 qualified medical expenses essentially allowing medical expenses to be deductible even for taxpayers taking the standard deduction. On top of all this, when the HSA owner reaches age 65, there is no longer a penalty for withdrawals from your HSA for purposes other than qualified medical expenses. This strategy has been referred to as “The Secret” IRA, and can be very attractive.

1 529 plans do not have a withdrawal deadline, but the timing of a distribution is critical. To be a qualified distribution, the money must be withdrawn in the same calendar/tax year that the qualified expenses were paid. If you withdraw the 529 money in December for a tuition bill that isn’t paid until January, you risk potentially having a non-qualified distribution. The same goes if you take a distribution in January to pay for expenses from the previous year.

2 If you reached the age of 70 1/2 in 2019 the prior rule applies, and you must take your first RMD by April 1, 2020. If you reach age 70 1/2 in 2020 or later, you must take your first RMD by April 1 of the year after you reach 72. However, the age to make a qualified charitable distribution (QCD) remains the same: 70 1/2.

Krilogy® does not provide tax and legal advice. Krilogy® is affiliated with Krilogy Tax Services, LLC through certain common ownership interest by Krilogy partners. Krilogy Tax Services provides tax planning and preparation services for an additional cost to Krilogy® clients. All expressions of opinion are subject to change. This information is distributed for educational purposes only, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services, nor is it to be construed as individualized advice or recommendations suitable for the reader. Please consult with your tax or financial professional.

All expressions of opinion are subject to change. This information is distributed for educational purposes only, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services, nor is it to be construed as individualized advice or recommendations suitable for the reader. Please consult with your tax or financial professional