A frequent question I hear from clients and prospects is whether or not to put extra money into the 401(k) while the stock market is down.

Three key questions can help you navigate this idea.

Question 1: What is your emotional outlook?

We need to be realistic with ourselves and our emotions surrounding money and investing.

Mathematically we “know” that we should buy low and sell high, but the follow-through can be tough, especially when your account is in the red and it seems be going down faster than a kayaker over a waterfall.

Buying in a down market may feel like buying ‘on sale’ to an optimist a long way from retirement.

It can also feel like, as one client put it, “throwing your money into a black hole.” This is not a great feeling if you are 64 and hoping to retire soon.

Pro-Tip: One of the psychological tricks I use for myself is to focus on the increase in my share quantities during a down market.

Question 2: How would your budget and short-term goals be affected?

How much of a strain will it put on your monthly cashflow to make a bigger contribution?

Having to burn through an emergency fund to cover living expenses to max out your 401k early could be the invitation Murphy is waiting for. Yes, technically you may be able to take a loan from your 401(k) if you absolutely needed it. Paying interest on your own money though? Avoid that if you can! We will cover 401(k) loans in a future post.

Foregoing the family vacation to buy a few more shares of a target date retirement fund probably won’t win you any parent of year awards either.

By contrast, if a substantial bonus is due, maybe increasing the 401(k) contribution for that particular pay period is a prudent move, especially if you are likely to spend that money on things that don’t help you reach your financial goals.

Question 3: Is it a smart move based upon the company plan design?

What happens if you max out your 401(k) early? Do you miss out on the match for the remainder of the year?

Possibly.

One of the most overlooked details in a company plan is the match structure.

-

- If the plan document stipulates the company match is calculated on an annualized basis, then regardless of when you made the contributions, you will receive the full match (as long as you meet the match threshold). This is called a “true-up” process.

- If your company match is based upon a per pay period match and does not include a “true-up” provision, then you could be missing out on employer match money by not contributing during every pay period.

Here are various scenarios using a hypothetical example of an individual earning $120,000 per year who plans to max out the company 401(k).

Note: Even if this individual was not “maxing out” the rules regarding true-up still apply.

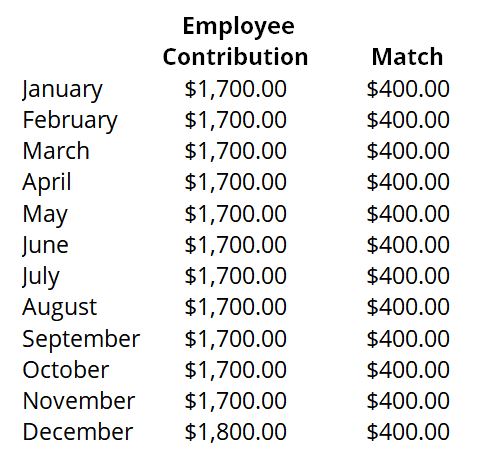

Contributions Averaged Over the Course of the Year

Total Employee Contribution – $20,500 (approx. 17% of salary)

Total Employer Match – $4,800 (4% company match)

Result – Received full 4% match

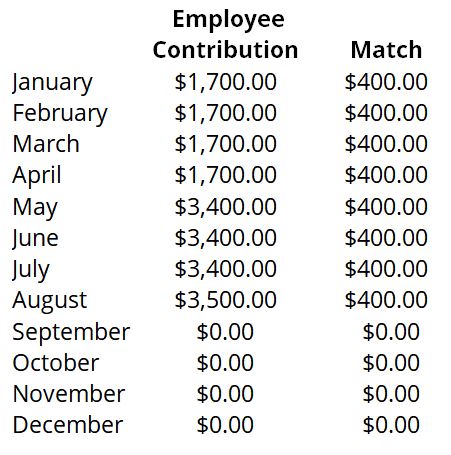

Early Max Out – Per Pay Period Match – No True Up

Total Employee Contribution – $20,500 (approx. 17% of salary)

Total Employer Match – $3,200

Result – Missed out on an extra $1,600 of company match

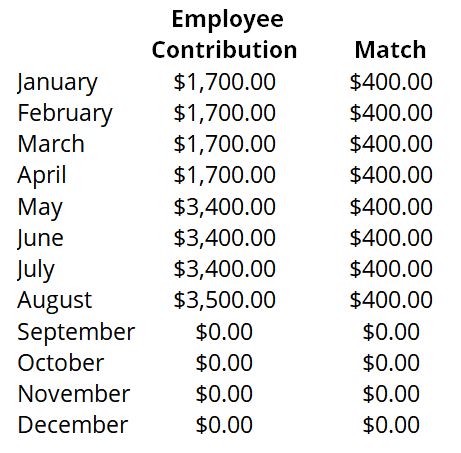

Early Max Out – Annualized Match – With True Up

Total Employee Contribution – $20,500 (approx. 17% of salary)

Total Employer Match – $3,200

True Up Test – Did employee contribute minimum of 4% of annual salary? YES

True Up Contribution – $1,600 added to account by employer

Result – Received full 4% match

It’s very important you know the details of your plan if you are considering any strategy where you may have pay periods with lower-than-the-match or zero contributions.

Missing out on an employer match could mean tens, if not hundreds, of thousands of dollars lost in retirement.

Before implementing any change to your investing strategy, it always makes sense to consult with your advisor regarding your specific situation. Our job at Krilogy is to dig deep and answer complex questions for our clients, especially when the answer may seem straightforward at the surface level.

All expressions of opinion are subject to change. This information is distributed for educational purposes only, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services, nor is it to be construed as individualized advice or recommendations suitable for the reader.

Diversification does not eliminate the risk of market loss. Investments involve risk and unless otherwise stated, are not guaranteed. Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. Investment risks include loss of principal and fluctuating value. There is no guarantee an investing strategy will be successful. Past performance is not a guarantee of future results.