Q2 2023 Review

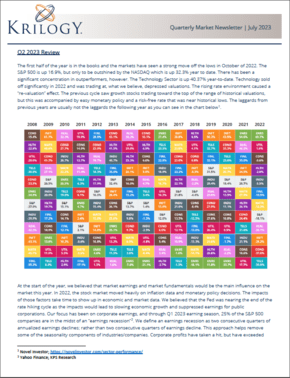

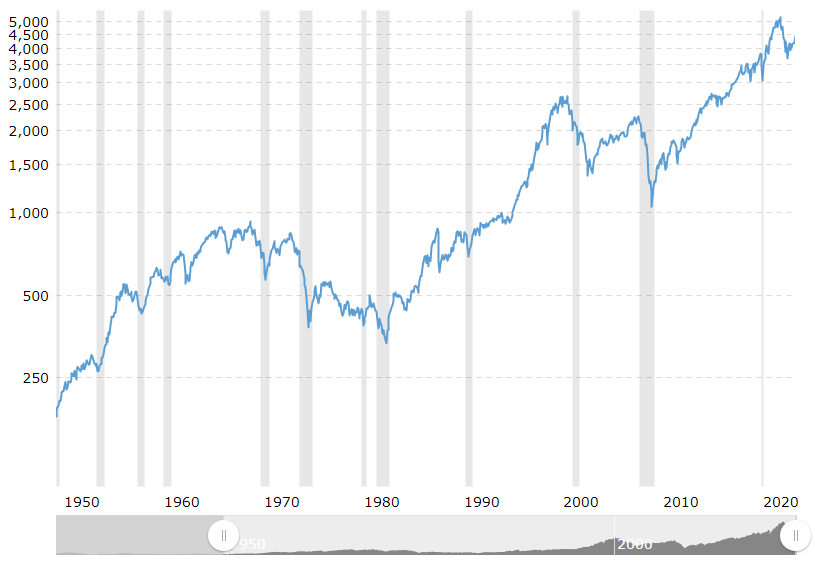

The first half of the year is in the books and the markets have seen a strong move off the lows in October of 2022. The S&P 500 is up 16.9%, but only to be outshined by the NASDAQ which is up 32.3% year to date. There has been a significant concentration in outperformers, however. The Technology Sector is up 40.37% year-to-date. Technology sold off significantly in 2022 and was trading at, what we believe, depressed valuations. The rising rate environment caused a “re-valuation” effect. The previous cycle saw growth stocks trading toward the top of the range of historical valuations, but this was accompanied by easy monetary policy and a risk-free rate that was near historical lows. The laggards from previous years are usually not the laggards the following year as you can see in the chart below1

At the start of the year, we believed that market earnings and market fundamentals would be the main influence on the market this year. In 2022, the stock market moved heavily on inflation data and monetary policy decisions. The impacts of those factors take time to show up in economic and market data. We believed that the Fed was nearing the end of the rate hiking cycle as the impacts would lead to slowing economic growth and suppressed earnings for public corporations. Our focus has been on corporate earnings, and through Q1 2023 earning season, 25% of the S&P 500 companies are in the midst of an “earnings recession”2. We define an earnings recession as two consecutive quarters of annualized earnings declines; rather than two consecutive quarters of earnings decline. This approach helps remove some of the seasonality components of industries/companies. Corporate profits have taken a hit, but have exceeded expectations so far this year. As of April 1st, first-quarter earnings estimates had S&P 500 earnings declining 5.1%, but actual reports came in essentially flat with earnings growth of 0.1%.

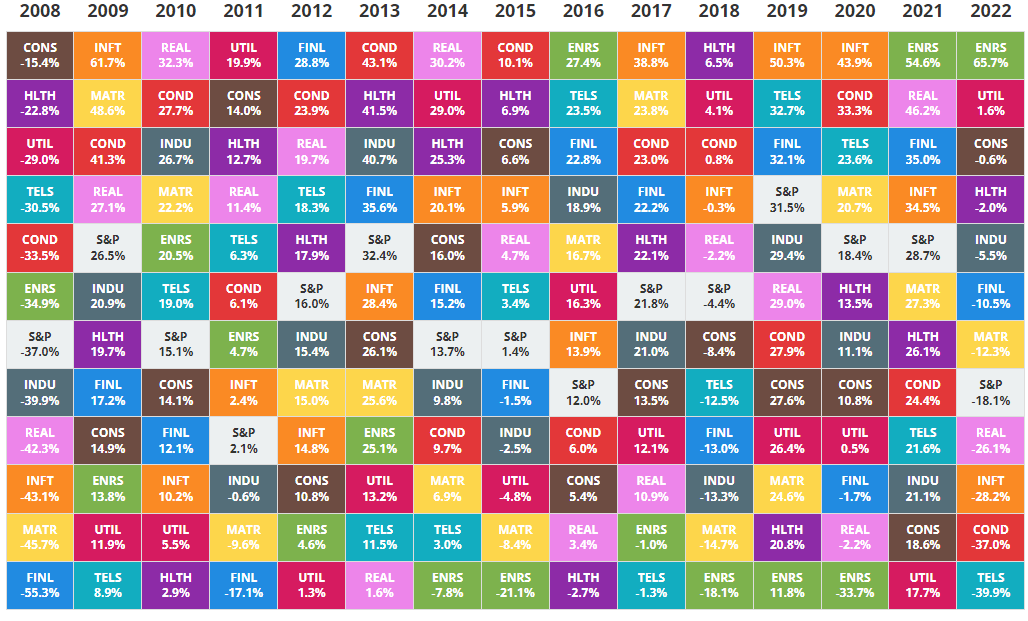

Going into the quarter, sentiment was deeply negative following the regional banking issues, but from a technical analysis perspective there was support for a contrarian bullish positioning on a near-term basis. This trend reversed through the quarter and now sits in stretched territory according to the Goldman Sachs Sentiment Indicator as seen above3. This points to the potential for short-term weakness in the equity markets, and a small near-term pullback is likely in our opinion.

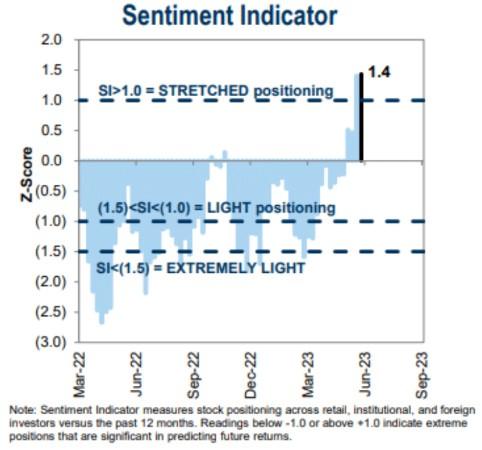

Understanding emotions during periods of a market cycle is important to set near-term expectations and strategy. Justin Mamis’ “The Nature of Risk Diagram” should help investors understand how investor emotions have the potential to impact subsequent market returns4.

Q3 2023 Outlook

Equity Market

The earnings decline has been pushed further out on the calendar. According to I/B/E/S data from Refinitiv, Q2 2023 earnings are expected to decline by 5.7%5. This compares to the decline of 3.9% from April 1st. Subsequent quarters have also had a reduction in estimates, but full-year 2023 earnings have remained flat, with 1.3% growth, due to the surprise results in the first quarter. Consensus estimates have 2023 earnings for the S&P 500 at 219.76. Using these estimates, the market is trading at 19.2x 2023 earnings, and on a forward four-quarter basis, the S&P 500 is trading at a 19.84x forward P/E. We believe this valuation is slightly extended and to see sustainable strength in the equity markets, earnings will need to exceed expectations going forward. The current rate environment will likely keep valuations suppressed and experiencing a long-lasting multiple-fueled expansion is not our base case.

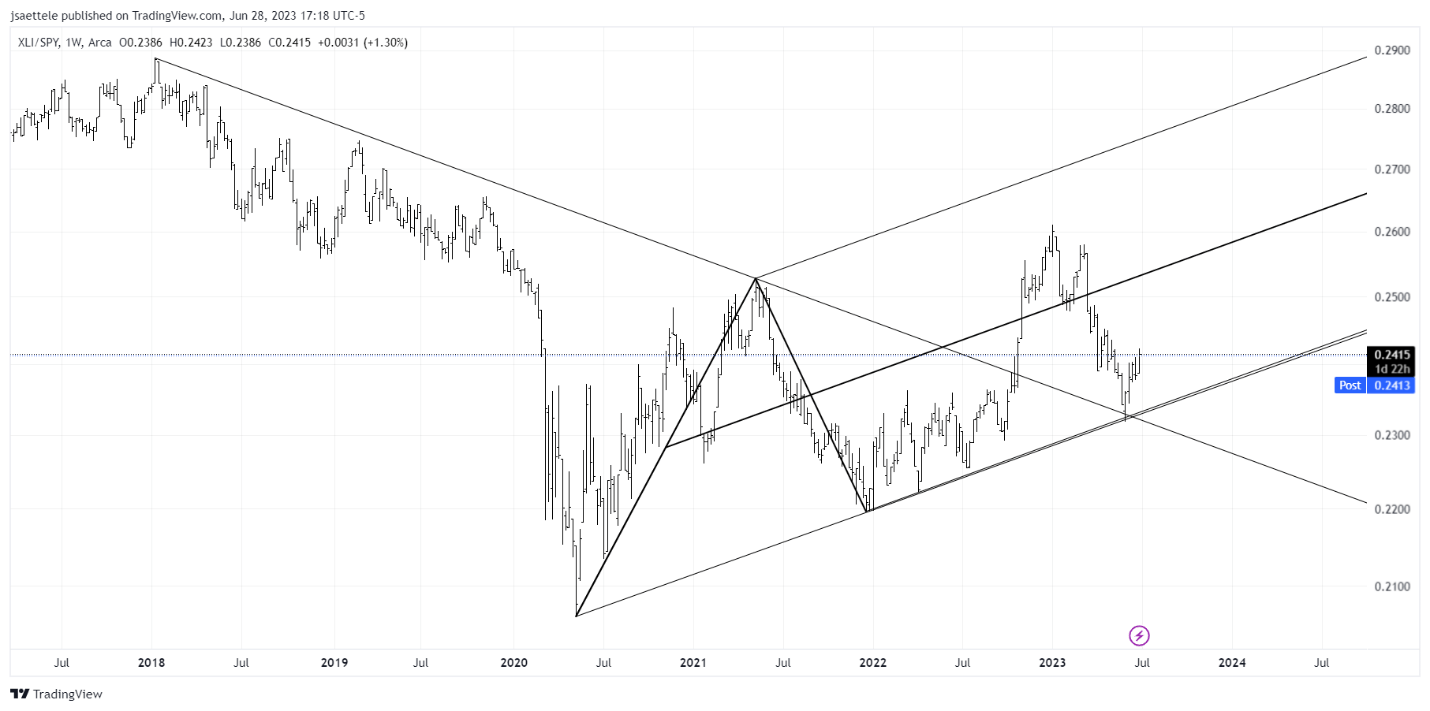

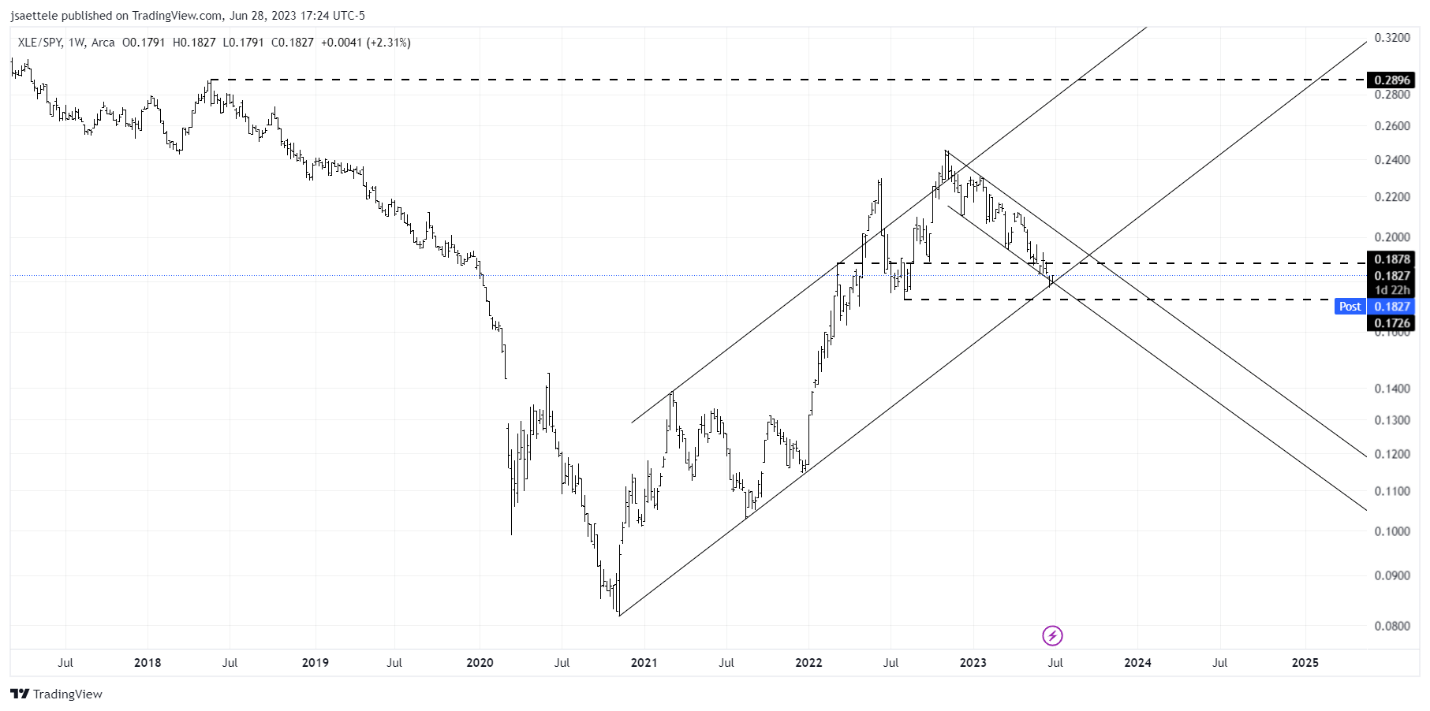

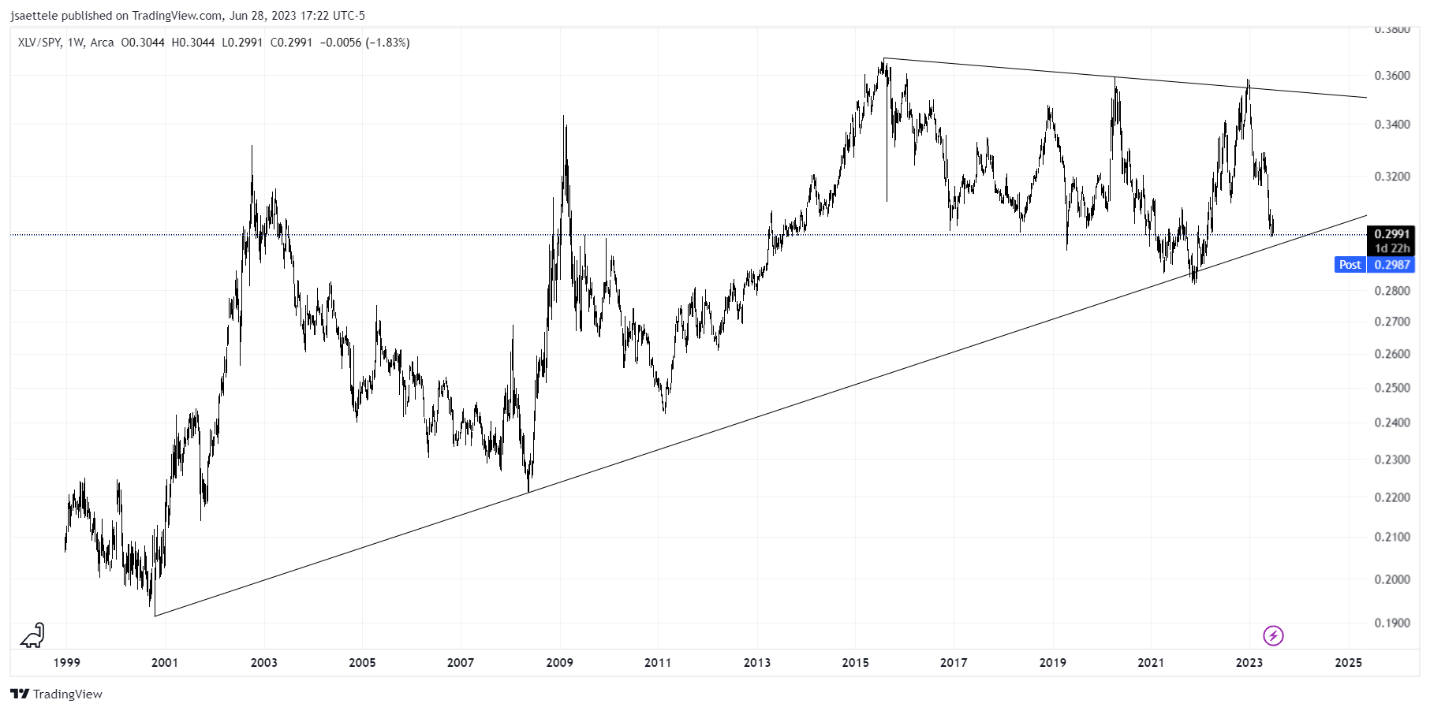

The market is vulnerable to a pullback in the near term, fueled by the lack of breadth during the rally so far this year. We believe cyclical sectors have the potential for stability if the pullback occurs due to the relative underperformance compared to the S&P 500, along with valuation support in many sectors that have lagged. More specifically, Healthcare, Energy, and Industrials are showing signs of a trend reversal that could occur as seen in the charts7 below.

Investors should remain focused on their long-term objectives and stay committed to their thoughtfully developed allocations. As the market navigates a new rate environment and mixed economic data, trends can shift quickly. Proper diversification should allow investors to capture these shifts and avoid concentrated exposure if a sector, style, and or region moves out of favor. This environment has many unknowns and very little agreement amongst some of the top market analysts/strategists. We believe a neutral view of the market is the best approach, given the various cross-currents discussed. Systematic rebalancing and maintaining a long-term view of the markets should help investors weather any short-term noise.

Fixed Income Market

At the midway point of the year, the following statement that we made at the end of Q1 still holds true:

”While we believe a recession is coming, the severity of it is not yet clear. We are in the mild recession camp and believe it will occur sometime in the second half…credit conditions are tightening.”

The second quarter was not as tumultuous as the first quarter, but we see nothing in the economic data that would change our opinion. The debt ceiling conundrum has been resolved. The regional banking systems deposit base has stabilized. The FTC bankruptcy was long ago in the rear-view mirror. Perhaps this is why the 10-year bond yield has been stable over the last couple of months. Currently, it stands at ~3.80% near where it began the year.

The inflation numbers have begun to roll over, M2 Money supply is crashing, the yield curve is severely inverted, and Leading Economic Indicators have been signaling a recession for some time now. All this adds up to a recession sometime in the not-too-distant future.

Of considerable note is the Federal Reserve’s response to the recent data, as we quote from the Wall Street Journal8

“Federal Reserve officials agreed to hold interest rates steady after 10 consecutive increases but signaled they are leaning toward raising them next month if the economy and inflation don’t cool more.

Most of them penciled in two more rate increases this year and lifted their expectations for growth and inflation in projections released Wednesday after their two-day policy meeting.”

It is our belief that the Fed has decided to “talk loudly but carry a small stick,” to paraphrase Teddy Rosevelt. We believe Chairman Powell is more concerned about inflationary expectations becoming embedded in the economy than he is about the overall rate of unemployment. This suggests that while short rates may well move slightly higher in the third quarter it could well be constructive for long rates and encourages our view that we expect rates to stay flat over the course of the year, finishing 2023 in the 3.25% to 3% range. No doubt there will be some opportunities to buy high three percent yields along the way, but these events will be fleeting. Higher-than-average volatility remains the order of the day.

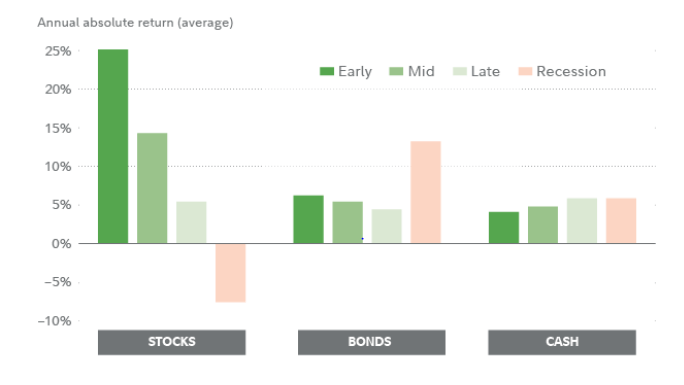

Our view is positive when looking at the fixed-income markets. Investors that had to search for yield by extending the duration or lower credit quality to find sufficient yield in the previous cycle no longer have the same challenge. High-quality bonds still have attractive yields. These high-quality bonds not only provide attractive income opportunities but in the event of an equity market drawdown, also have the potential to provide significant negative correlation that should help anchor a portfolio during equity market volatility. As seen below, bonds have historically outperformed all other asset classes during a recession9.

Conclusion

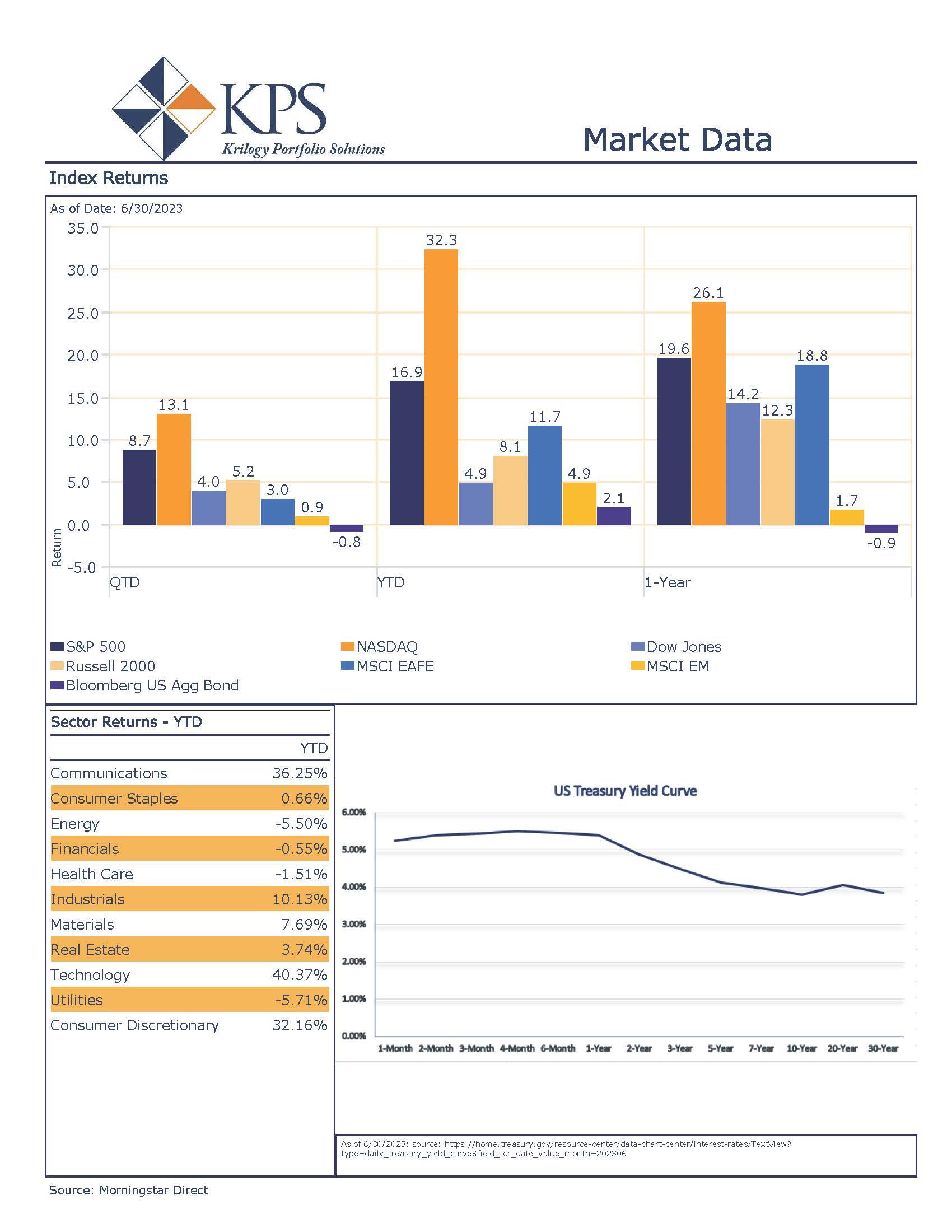

An economic slowdown will come, but the market impacts could be less severe than what we have recently witnessed during a recession. “Rolling Recession” is a term that is starting to become more popular, and this scenario is not out of the question. We saw the housing sector have a steep slowdown last year, and we could see individual sector weakness at differing times, which would likely have smaller impacts on the stock market. Investors should remember that the economic cycle and the stock market historically have not had a one-to-one correlation. An economic slowdown does not mean a market breakdown will occur. Also, the stock market acts as a discounting mechanism and has historically bottomed before economic and earnings numbers have bottomed.

There are very few things in the stock market that investors can have near 100% confidence in, but there are a few. We will see a recession at some point, but nobody knows when. And, in the short to intermediate term the stock market will move up and down, but historically it goes up. The S&P 500 chart above shows that despite periods of market weakness, the market continues its trek higher10.

At Krilogy®, we are committed to helping you effectively navigate the ever-changing market environment. As long-term investors we believe it is critical to remain patient and stick to the plan that was developed for your unique situation to arrive at a personal allocation target. Our entire team remains dedicated to helping you achieve your financial goals.

Sources

[1] Novel Investor; https://novelinvestor.com/sector-performance/

[2] Yahoo Finance; KPS Research

[3] Isabelnet; https://www.isabelnet.com/sentiment-indicator-and-stock-positioning/

[4] Mamis, Justin. November 1999. Fraser Publishing Company.

[5] I/B/E/S Refinitiv; https://lipperalpha.refinitiv.com/wp-content/uploads/2023/06/TRPR_82201_20230630.pdf

[6] Yardeni Research Inc.; https://www.yardeni.com/pub/yriearningsforecast.pdf

[7] Trading View: KPS Research

[8] The Wall Street Journal; https://www.wsj.com/articles/nikkei-rises-1-4-amid-risk-on-sentiment-af628ff3

[9] Fidelity Investments; https://www.fidelity.com/learning-center/trading-investing/how-to-invest-during-recessions

[10] MacroTrends; https://www.macrotrends.net/2324/sp-500-historical-chart-data

Important Disclosures

Investment Advisory Services offered through Krilogy®, an SEC Registered Investment Advisor. Please review all prospectuses and Krilogy’s Form ADV 2A carefully prior to investing. This is neither an offer to sell nor a solicitation of an offer to buy the securities described herein. An offering is made only by a prospectus to individuals who meet minimum suitability requirements.

All expressions of opinion are subject to change. This information is distributed for educational purposes only, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Diversification does not eliminate the risk of market loss. Investments involve risk and unless otherwise stated, are not guaranteed. Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. Investment risks include loss of principal and fluctuating value. There is no guarantee an investing strategy will be successful. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

Services and products offered through Krilogy® are not insured and may lose value. Be sure to first consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.