A Historic Market Recovery

We hope this letter finds you safe and healthy during these still-unprecedented times. 2020 continued to be one of the most unpredictable years in memory. Markets rose to new all-time highs in the third quarter despite a resurgence in coronavirus cases. Stocks rallied thanks to a combination of even more accommodative Fed policy, hopes for a COVID-19 vaccine, and a stronger-than-expected economic rebound. Markets declined moderately from those highs in mid-September.

The third quarter began with a resurgence of coronavirus cases in the United States. New daily cases of COVID-19 smashed through levels seen in March and April, eventually topping out at a record 78,871 new cases on July 24. But unlike March and April, stocks did not decline following the spike in new cases. State governments enacted more surgical economic shutdowns instead of the wholesale lockdowns that occurred in the first half of the year. That change in strategy, combined with the fact that hospitalization rates and mortality rates of COVID-19 remained far below March and April levels, helped the stock market look past the increase in cases. The S&P 500 rose 5.51% in July.

The rally continued in August, aided by the peak and subsequent decline of coronavirus cases in some of the largest U.S. states (California, Florida, and Texas). Additionally, despite the expiration of the CARES Act stimulus, U.S. economic data continued to improve throughout August, powering stocks higher. In late August, the Federal Reserve formally announced the adoption of an “average inflation target,” which effectively signaled the Fed would tolerate higher inflation in the economy more so than in recent history. That policy shift is a potentially longer-term bullish event for stocks, as they are positively correlated to higher inflation. Led by gains in the tech sector, the S&P 500 hit a new all-time high in mid-August and the rally continued through month-end. The S&P 500 rose 7.01% in August and finished the month in solidly positive territory on a year-to-date basis.

The final month of the third quarter, however, provided a reminder that the macroeconomic outlook remains uncertain and markets can still quickly become volatile. The August tech rally was so relentless that the financial media compared it to the tech bubble of the 2000s. While that was somewhat hyperbolic, the pace of the gains in the tech sector simply wasn’t sustainable. In the first few days of September the tech rally became exhausted, the Nasdaq peaked, and stocks began a correction process that would last for most of the month. The catalyst for the initial declines was buyer exhaustion. But there were also some incrementally negative events in September that weighed on stocks.

- It became evident there would be no new economic stimulus bill in September, as both Democrats and Republicans remained far apart in negotiations.

- Economic data began to imply a “plateau” in the economic recovery.

- Late in the month, coronavirus cases surged in Europe and began to move higher again in certain U.S. states, prompting some concern about a return to various levels of economic lockdown in Europe and the U.S.

The S&P 500 declined modestly in September but remained solidly positive for the third quarter.

As we begin the final quarter of this historic year, the September market correction helped reset expectations about the numerous unknowns still facing investors in both the short and long term. But while the September pullback was a reminder of potential market volatility, we start the final quarter of 2020 at more reasonable market valuations, historically speaking.

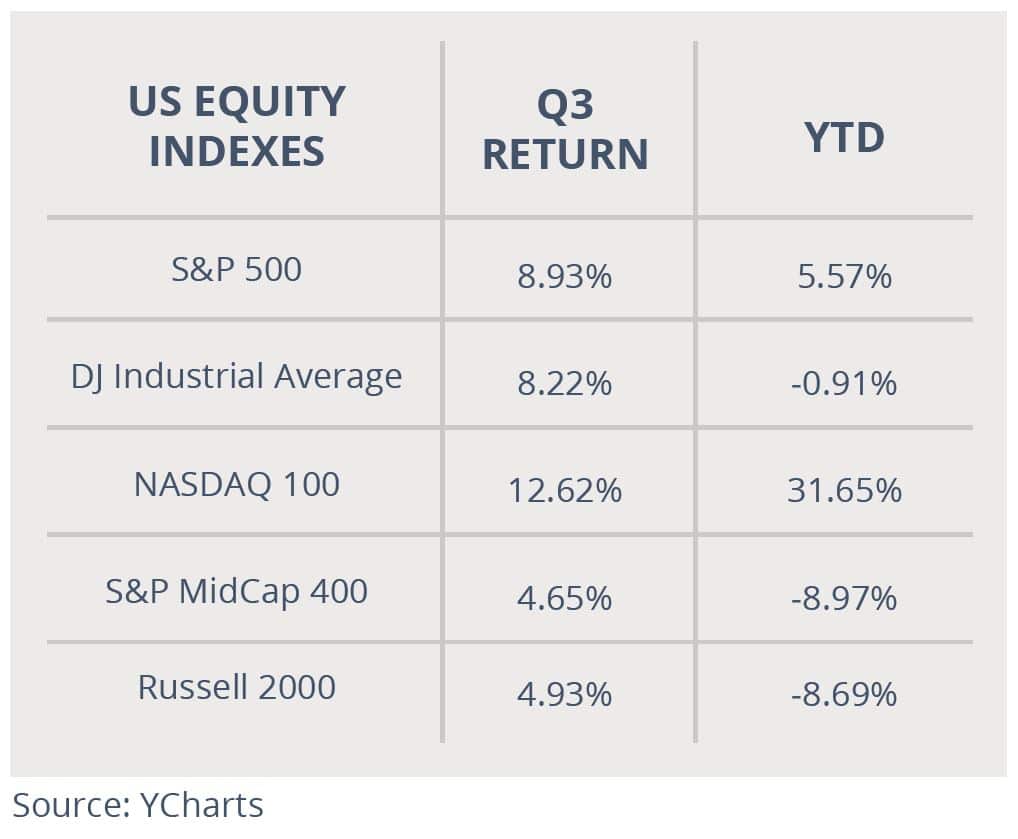

Q3 Market Performance Review – New All-Time Highs

The major U.S. stock indices all extended the rebound that began in the second quarter of 2020. Just like the previous two quarters, the tech-heavy Nasdaq outperformed the other major indices. Those gains were once again driven by the performance of some of the largest, most well-known tech companies in the world, which are viewed as the longer-term beneficiaries of changing personal and professional behavior in response to the pandemic. Stocks such as Apple (AAPL), Amazon (AMZN), Google (GOOGL), and Netflix (NFLX) helped send the Nasdaq to new all-time highs in July, August, and early September.

By market capitalization, large-cap stocks outperformed small-cap stocks, a reversal from the second quarter.

- Large caps outperformed primarily because doubts remain about how quickly the U.S. economy will return to pre-COVID-19 levels, especially with the expiration of economic stimulus in late July.

- Small caps are historically more sensitive to changes in broad economic growth. That uncertainty weighed on small-cap indices, although they still finished with a positive return for the quarter.

From an investment style standpoint, growth outperformed value, yet again, because of strength in large-cap tech.

On a sector level, 10 of the 11 S&P 500 sectors finished with a positive return for the third quarter. As previously mentioned, tech outperformed. But so did consumer discretionary and materials sectors. Investors rotated into some of the hardest hit sectors in the market on the hope that coronavirus cases would continue to recede and people would venture back out into the economy; visiting malls and restaurants, and traveling sooner than previously expected.

Defensive sectors, which are historically less sensitive to expected changes in the economy (such as utilities, consumer staples, and healthcare), lagged the S&P 500 in the third quarter although they all posted solidly positive quarterly returns. The only S&P 500 sector to finish with a negative return in the quarter was energy, as investors continued to worry about future global demand in the context of still-elevated oil supplies.

International markets rallied in the third quarter as European and Asian economies continued to re-open. But many foreign developed markets closed well off the highs of the quarter as coronavirus cases spiked in parts of Europe, particularly in Great Britain. Emerging markets outperformed foreign developed markets thanks to a continued decline in the U.S. dollar, paired with strength in Asian markets, as the coronavirus outbreak remains broadly contained in that region of the world.

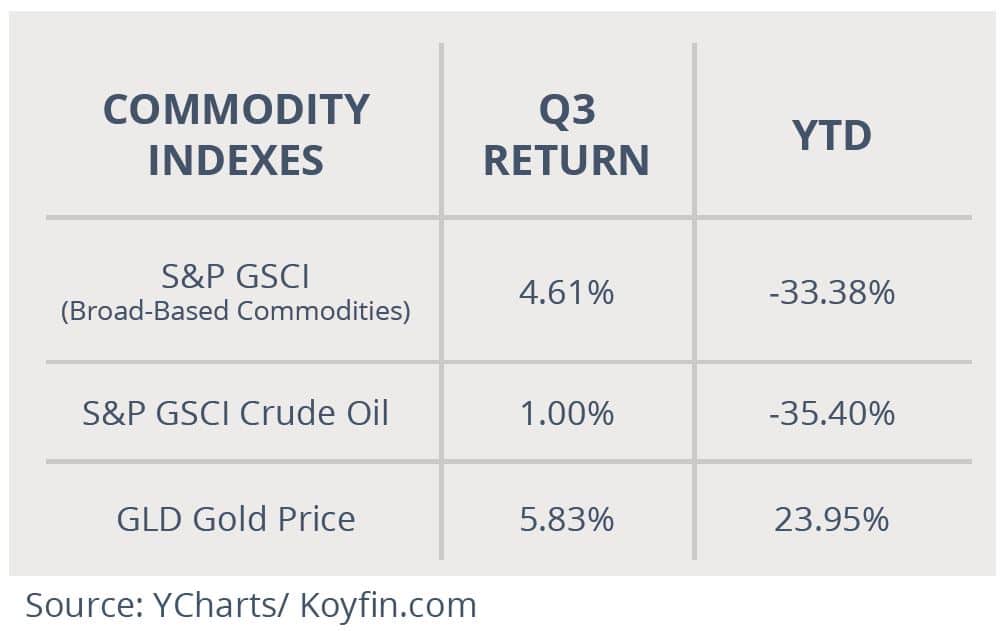

Commodities also moved higher in the third quarter thanks to a declining U.S. dollar and cautious optimism for an eventual global economic rebound. Oil prices were volatile in the third quarter but still finished with a positive return as OPEC maintained discipline on supply cuts which helped offset concerns about global oil demand expectations. Gold, meanwhile, added to the gains of the second quarter thanks to the aforementioned weakness in the U.S. dollar, still-recovering inflation expectations, and steady bond yields amid the historic global central bank stimulus.

In fixed income markets, the total return for most bond classes was again positive in the third quarter. Bonds now have realized a positive return for each quarter so far this year. The leading benchmark for bonds, the Bloomberg Barclays US Aggregate Bond Index, saw slightly positive returns in third quarter marking the eighth consecutive quarterly gain.

Longer-duration bonds again outperformed those with shorter durations in the third quarter. Global central banks (including the Federal Reserve) reiterated that rates would stay low for years to come. That anchored shorter-duration bonds and, in turn, increased the appeal of higher-yielding, longer-maturity bonds.

Corporate bonds again saw solidly positive returns in the third quarter thanks to the better-than-expected economic recovery. High-yield bonds outperformed investment-grade bonds during the quarter, reflecting surprisingly strong corporate commentary during the most recent earnings season combined with optimism that a continued decline in coronavirus cases would help business continue to recover.

4th Quarter Market Outlook

Markets and the economy have staged a historic rebound since the late March lows. While we all welcome this impressive comeback, we enter the final quarter of the year keenly aware that some of the biggest unknowns for the markets and the economy will be resolved positively or negatively in the next three months.

Starting with the obvious, November 3 is Election Day. Apropos for 2020, this election will be one of the most uncertain in our lifetimes. Beyond the most important question (“Who will win the Presidency?”), markets are also focused on whether the Democrats will be able to take control of the Senate. If so, and if former Vice President Joe Biden wins the Presidency, Democrats would control both the legislative and executive branches of government in a scenario dubbed the “Blue Wave” by the financial media. Such a scenario would result in the increased potential for policy changes which would likely create short-term market volatility.

However, any near-term volatility associated with a “Blue Wave” would likely be small compared to the worst-case scenario for the election. If there is no clear winner by the end of Election Day and the election becomes contested, the entire country faces being dragged through an episode similar to Bush vs. Gore in the early 2000s. In that outcome, we should expect significant short-term market volatility until a winner is declared, potentially as late as mid-December.

Unfortunately, the election is not the only source of potential uncertainty and volatility coming in the next three months. Hopes for a COVID-19 vaccine have helped stocks rally to current levels, with three separate vaccines undergoing final phase 3 trials. Those trials will likely reach their conclusion in the coming weeks, perhaps before the election. If those trials fail to produce a viable vaccine candidate, that will also create volatility as markets are expecting widespread COVID-19 vaccine distribution by early to mid-2021.

Finally, by the end of the fourth quarter investors will learn the fate of the stimulus bill currently stuck in Congress. There’s near-universal agreement the economy could use more stimulus. But the politics of the election, combined with Republican and Democrat differences about how much money should be spent and where that money should go, have prevented stimulus from being passed and delivered to the U.S. economy. Markets expect a stimulus bill to pass by year-end. If that fails to materialize, it will create more volatility.

Bottom line, the resiliency of the U.S. economy and markets is both admirable and encouraging. The economic and market recovery from the worst pandemic in 100 years has been nothing short of extraordinary. That rebound verifies the value of sticking to a well-constructed, diversified financial plan aimed at achieving long-term investment goals. However, experience has taught us not to be complacent simply because the market has been resilient. While we have all welcomed the strong market rebound in Q2 and Q3, the fact remains that a lot of important unknowns will be resolved in Q4. Because of that, there is the possibility for more market volatility during the final three months of 2020.

While short-term volatility might reappear between now and year-end, the markets in 2020 have once again demonstrated that a long-term approach combined with a well-designed and well-executed investment strategy can overcome periods of elevated volatility, market corrections, bear markets, and even global pandemics.

At Krilogy, we understand the risks facing both the markets and the economy. We are committed to helping you effectively navigate this challenging investment environment. Successful investing is a marathon, not a sprint. Even intense volatility like we experienced in the first half of this year is unlikely to alter a diversified approach set up to meet your long-term investment goals.

Therefore, it is critical for you to stay invested, remain patient, and stick to the plan. We have worked with you to establish a unique, personal asset allocation target based on your financial position, risk-tolerance, and investment timeline.

Finally, we thank you for your ongoing confidence and trust. Please rest assured that our entire team will remain dedicated to helping you successfully navigate this market environment.