A Historic First Half of 2020

We hope this letter finds you safe and healthy during these unprecedented times.

Markets staged a historic rebound in the second quarter driven by an initial peak in the growth of coronavirus infections in April, economic reopenings across the United States and the rest of the world, hopes for a COVID-19 vaccine, and continued stimulus from global central banks including the Federal Reserve.

The end of the first quarter marked the lows for markets so far in 2020. New coronavirus cases in the U.S. began to peak in mid-April amid the historic economic shutdown. That peak and initial decline in new COVID-19 cases gave investors and markets hope that the economic shutdown would not last into the summer. The S&P 500 rallied materially as a result, gaining more than 12% in April.

The rebound continued in May as the spread of the coronavirus continued to slow, paving the way for economic re-openings in the U.S. and abroad. By the end of May all 50 states had at least partially reopened their economies, which led to a stronger than-expected economic recovery. Meanwhile, markets were supported by continued economic stimulus from both the Federal government (via unemployment checks and Payroll Protection Program loans to businesses) and the Federal Reserve (via bond purchases). The S&P 500 rallied more than 4% in May while the Nasdaq Composite turned positive for 2020, a development that seemed almost impossible during the depths of the March declines.

But the two-plus-month rally was interrupted in mid-June, coinciding with a sudden resurgence in coronavirus cases. Numerous states including Florida, Texas, Arizona, and California saw coronavirus cases begin to increase mid-month. By the last week of June new daily COVID-19 cases in the U.S. hit an all-time high. As a result, volatility edged higher into the end of June. However, the market reaction was muted compared to the volatility in February and March, as the increased case count had not put extreme stress on various state healthcare systems.

Looking forward, as we begin a new quarter and the second half of 2020, the macroeconomic outlook has improved meaningfully since March. Stocks have responded accordingly with an extraordinarily strong rally off the March lows. But the last two weeks of June were a stern reminder that much uncertainty remains. During the next several months we will learn whether the coronavirus outbreak will peak and if the economic recovery we have seen since April can continue. Those factors, along with the increasing influence of politics given the November election, will impact markets in the months ahead.

2nd Quarter Market Performance Review – A Historic Rebound

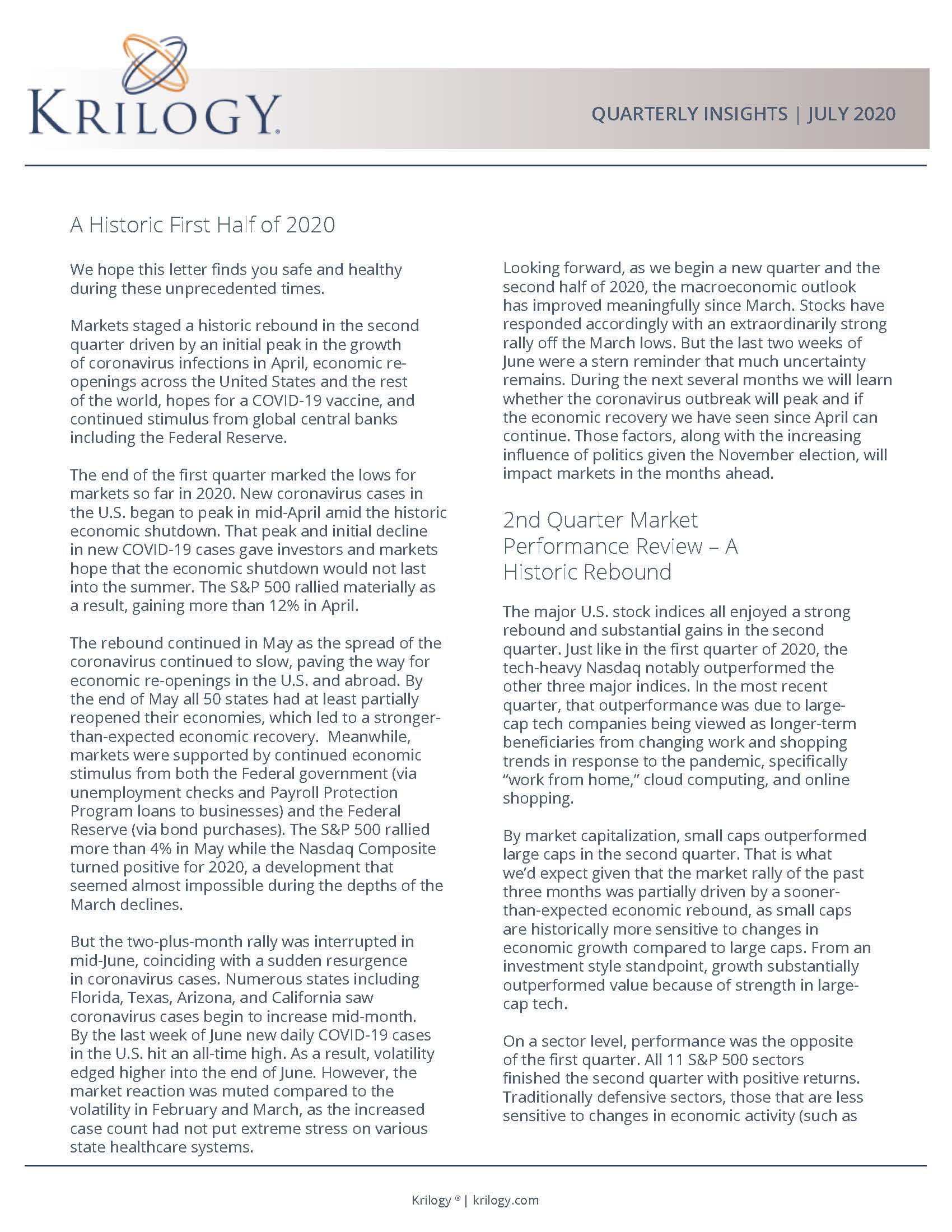

The major U.S. stock indices all enjoyed a strong rebound and substantial gains in the second quarter. Just like in the first quarter of 2020, the tech-heavy Nasdaq notably outperformed the other three major indices. In the most recent quarter, that outperformance was due to large-cap tech companies being viewed as longer-term beneficiaries from changing work and shopping trends in response to the pandemic, specifically “work from home,” cloud computing, and online shopping.

By market capitalization, small caps outperformed large caps in the second quarter. That is what we’d expect given that the market rally of the past three months was partially driven by a sooner than-expected economic rebound, as small caps are historically more sensitive to changes in economic growth compared to large caps. From an investment style standpoint, growth substantially outperformed value because of strength in large-cap tech.

On a sector level, performance was the opposite of the first quarter. All 11 S&P 500 sectors finished the second quarter with positive returns. Traditionally defensive sectors, those that are less sensitive to changes in economic activity (such as utilities, consumer staples, and healthcare) relatively underperformed after outperforming in the first quarter. Again, that is historically typical when stock market gains are driven by expectations for improving economic growth.

Cyclical sectors, those that are more sensitive to changes in economic activity (such as energy, consumer discretionary, and materials), outperformed in the second quarter along with the technology sector. Energy, the worst performing sector in the first quarter, was the best performing sector in the second quarter thanks to a significant rebound in oil prices and growing expectations for a global economic recovery.

Source: YCharts

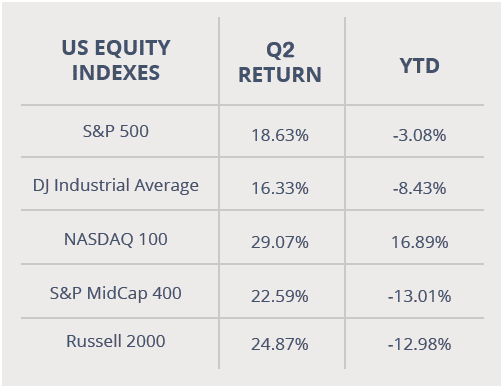

International markets also rallied in the second quarter. European and Asian economies re-opened while recording a consistent decline in new COVID-19 cases throughout the quarter. Emerging markets, whose economies are typically more sensitive to changes in expected global growth, modestly outperformed both foreign developed markets and the S&P 500. Reasons include a declining U.S. dollar paired with rising hope for a global economic rebound, following successful re-openings in Asia and parts of Europe.

Source: YCharts

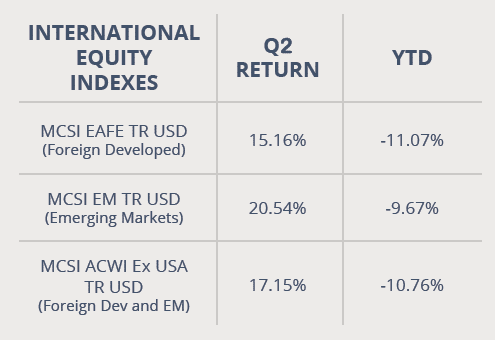

Commodities also staged a large rebound in the second quarter as prices were driven higher by firming global growth expectations. Oil was historically volatile in the second quarter, with prices briefly turning negative in late April due to a short-term supply glut. But an extension to the unparalleled OPEC+ agreement to slash oil production, paired with evidence of returning consumer demand for refined products, sent oil sharply higher into the end of the second quarter. Gold added to the gains of the first quarter thanks to a declining U.S. dollar, recovering inflation expectations, and steady bond yields amid the historic global central bank stimulus.

Source: YCharts

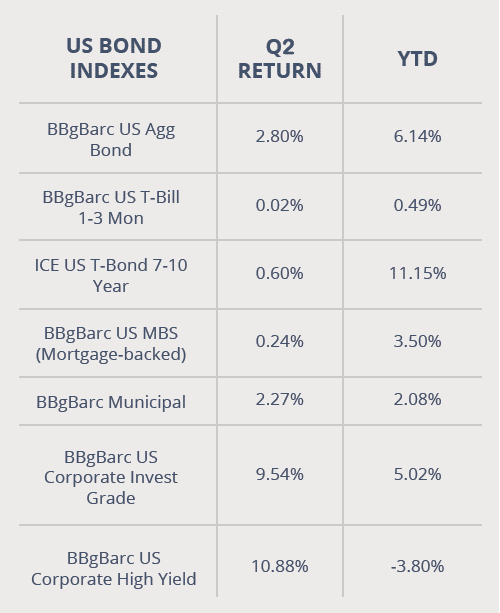

Turning to fixed income markets, the total return for most bond classes was again positive in the second quarter. Bonds joined gold in registering back-to-back positive quarterly returns so far in 2020. The leading benchmark for bonds, the Bloomberg Barclays US Aggregate Bond Index, saw positive returns for the seventh straight quarter.

Longer-duration bonds outperformed those with shorter durations in the second quarter. Global central bank commentary stated that rates would stay low for years to come, which anchored shorter duration bonds and increased the appeal of higher yielding, longer-maturity bonds.

Corporate bonds, in a sharp reversal from the first quarter, saw solidly positive returns in the second quarter thanks to optimism surrounding the economic reopening process combined with the Federal Reserve actively buying corporate bonds to ensure adequate liquidity. Investment-grade bonds outperformed high yield corporate bonds, due in part to that active buying from the Fed as well as lingering worries about how weaker companies would fare over the longer term as the global economy slowly reopens.

Source: YCharts

3rd Quarter Market Outlook

What a difference a quarter can make. Markets enjoyed a historic rebound in the second quarter thanks to an initial peak in coronavirus cases, continued government support, and a quicker-than-anticipated economic recovery. Like markets, society also made a substantial rebound in the second quarter. Economies have at least partially reopened in all 50 states, people are starting to return to the office, families are taking summer vacations, and there’s even the hope for a return of sports and other cultural staples in the coming weeks and months. Indeed, we have come a long way from those panicked days of late March.

But while we all welcome progress, it would be a mistake to think uncertainty and market volatility are behind us.

The outlook for the spread of the coronavirus is still very unclear. New cases hit record highs in late June, providing a somber signal that the virus will be with us, in one form or another, for some time to come.

Additionally, the fate of the historic stimulus enacted back in March remains uncertain as of this writing. Paycheck Protection Program loans, which provided critical assistance to small businesses over the past three months, may no longer be available. It remains unclear what will become of the federal unemployment benefits included in the CARES Act, as they are set to expire at the end of July. That federal stimulus played a critical role in the bigger-than-expected economic rebound witnessed in the second quarter. Without it, the economic outlook will become increasingly uncertain.

Regarding the economy, while progress has been better-than-expected, it’s important to remember that the current level of economic activity remains far below the levels of a year ago. Despite the gains seen in the second quarter, there remains a long road ahead for the U.S. economy to return to pre-pandemic levels.

Politically, markets have largely ignored the looming presidential election so far, but that is likely to change in the coming months. It is reasonable to assume the outlook for the election will begin to influence not just specific sectors, but also the broad markets during the third quarter.

Finally, while essential to the economic recovery so far in 2020, the historic government stimulus unleashed on the U.S. economy has also resulted in an explosion of debt and surging deficits. Over the longer term, this trajectory is not sustainable. We are mindful of this fact as we craft long-term investment plans.

As we start the second half of the year, there has been a lot of progress on the economic and health fronts, but a lot of uncertainty remains. We can take comfort in the fact that there are still many tailwinds on these markets, including historic support and stimulus not only from the Federal Reserve, but also from every major global central bank. Additionally, global governments are stimulating their economies in ways that haven’t been seen since the end of World War II, and the global medical community is united in an historic effort to produce a vaccine for COVID-19.

Bottom line: Investors are currently facing a lot of unknowns as we begin the second half of 2020, but there are also powerfully positive forces supporting markets.

We all know that past performance is not indicative of future results. But history has shown that a long-term approach combined with a well-designed and well-executed investment strategy can overcome periods of heightened volatility, market corrections, and even bear markets. And we’ve seen that again so far in 2020.

At Krilogy, we understand the risks facing both the markets and the economy. We are committed to helping you effectively navigate this challenging investment environment. Successful investing is a marathon not a sprint. Even intense volatility, like we experienced in the first half of this year, is unlikely to alter a diversified approach to meet long-term investment goals.

Therefore, it’s critical for you to stay invested, remain patient, and stick to the plan. We have worked with you to establish a unique, personal allocation target based on your financial position, risk tolerance, and investment timeline.

Finally, we thank you for your ongoing confidence and trust. Please rest assured that our entire team will remain dedicated to helping you successfully navigate this market environment.