Earnings, Economic Growth and Vaccines Push Stocks to New Records in 2021

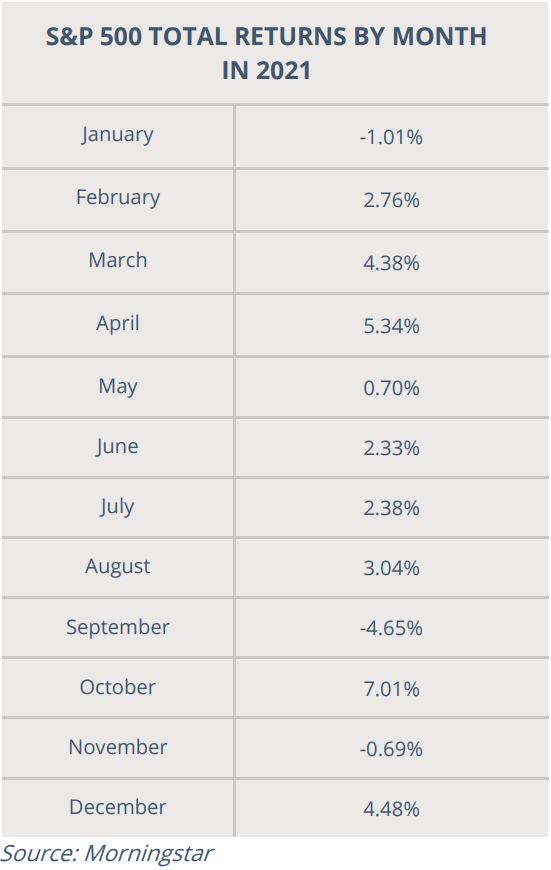

Stocks overcame numerous headwinds during the past three months, including a resurgence in COVID cases, the Federal Reserve moving aggressively to end the current QE program, and a lack of additional stimulus from Washington, to hit new all-time highs in the fourth quarter and produce very strong returns for 2021.

The fourth quarter started with a continuation of the volatility we saw at the end of the third quarter. In early October there was still little progress in Washington on extending the debt ceiling, avoiding a government shutdown, or providing investors clarity on future tax changes in the Build Back Better bill. That political uncertainty combined with concerns over third quarter corporate earnings results sent stocks lower to start the fourth quarter.

By the middle of October, Republicans and Democrats had extended the debt ceiling and avoided a government shutdown. Many of the tax increases proposed in the Build Back Better bill were removed, which eased investor anxiety about future tax increases. The third-quarter earnings season proved to be better than feared as corporate America again proved resilient. The vast majority of companies posted better-than expected results and 2022 S&P 500 earnings expectations rose yet again. Each of those positive developments helped send the S&P 500 sharply higher in October as the S&P 500 recouped all the September losses and hit a new all-time high late in the month.

The positive momentum continued in early November. The S&P 500 drifted steadily higher given the tailwinds of clarity from Washington, strong earnings, and declining COVID cases. While the Federal Reserve announced it would begin to reduce, or taper, its Quantitative Easing (QE) program starting in November, the pace of the reductions met investor expectations. Markets continued to rally and hit new all-time highs in mid-November.

Then, on Thanksgiving Day, the World Health Organization declared the Omicron variant of COVID-19, which had just been discovered in South Africa, a “variant of concern.” This caused a sharp selloff in stocks, partially thanks to very low liquidity, as governments once again closed borders to international travel, and the world wearily braced for another increase in cases. During his Congressional testimony in late November, Federal Reserve Chairman Jerome Powell surprised markets. He stated that due to persistently high inflation, the Fed would likely need to accelerate the just-announced tapering of QE and endorsed doubling the pace of reduction. That acceleration came less than a month after the Fed’s initial tapering announcement and caused markets to price in sooner-than-expected interest rate hikes in 2022. Concerns about future Fed policy combined with Omicron uncertainty led to declines in stocks late in November. The S&P 500 finished the month with a small loss. Markets rebounded in December as the Fed delivered less aggressive messaging on rate hikes and governments did not impose economically crippling lockdowns in response to the surging Omicron outbreak.

First, the Fed announced in December that it will accelerate the tapering of QE in 2022, and that QE would end in mid-March, about three months earlier than expected. The Fed also signaled it expected to raise interest rates three times in 2022 to combat rising inflation. Both of those announcements largely met the latest market expectations, and Powell’s reassuring commentary that the Fed would remain supportive of the economy helped ease investors’ concerns that interest rates would rise too quickly in 2022. Stocks rallied in the wake of the Fed decision.

Late in the month, multiple studies implied that the Omicron variant, while more contagious than previous strains, resulted in substantially fewer severe COVID cases. There would likely be new records in daily cases due to Omicron, but the risk of hospitalizations and deaths remained low. Governments could avoid lockdowns such as those seen in March 2020. That news helped stocks extend the rally late in December, and the S&P 500 finished the month with a four percent gain. 2021 was another historic year for markets and the S&P 500 ended near new all-time highs. Governmental policy remained supportive of the economy, corporate earnings growth was strong, and substantial progress was made against the pandemic. Those positives were reflected in the very strong market returns, especially in the final quarter of the year.

Q4 and Full Year 2021 Performance Review

All four of the major U.S. stock indices were higher for the fourth quarter, with the tech-heavy Nasdaq slightly outperforming the S&P 500. The Dow Industrials modestly lagged both these indices. The small-cap focused Russell 2000 registered only a small gain for the fourth quarter. Concerns about economic headwinds from the Omicron variant and the Fed’s more aggressive QE tapering and rate hike schedule weighed on small-cap companies, as investors sought relative safety in large-cap tech amidst the rising possibility of slower economic growth in 2022. On a full-year basis, all four major indices posted positive returns, with the S&P 500 slightly outperforming the Nasdaq for the first time since 2016. The Russell 2000 relatively underperformed thanks to lackluster returns during the second half of 2021, as the Delta and Omicron variants weighed on economic growth.

By market capitalization, large caps handily outperformed small caps both in the fourth quarter and throughout 2021. Concerns about future economic growth were the main driver of large-cap outperformance and small-cap underperformance especially in the second half of 2021. The Delta and Omicron variants were headwinds on economic growth in the second half of the year, while the Fed’s potentially higher than-expected rate hikes made the growth outlook for 2022 less certain. Those two factors drove a rotation from small caps to large caps in the third and fourth quarters.

From an investment style standpoint, a late-year rally in large-cap tech helped growth outperform value both in the fourth quarter and for the full year. That outperformance reflected the deceleration in economic growth during the second half of 2021 due to Delta and Omicron.

On a sector level, 10 of the 11 S&P 500 sectors finished the fourth quarter with positive returns, with the tech and real estate sectors leading the way. Tech benefitted from the rotation to safety amidst COVID and Fed policy uncertainty. Real estate rose as investors priced in a continued rise in inflation, as real estate has had strong historical returns during periods of elevated inflation. For 2021, energy was by far the best performing sector in the market as a surge in oil and natural gas prices helped energy handily outperform all other market sectors. Real estate, tech, and financials were also strong performers for the full year 2021, as investors sought protection from inflation via real estate and financials. Tech benefitted from continued strong earnings growth and the familiar defensive rotation following the Delta and Omicron waves.

The only S&P 500 sector to post a negative return for the fourth quarter was communication services, as investors rotated out of internet focused tech stocks and into more diversified technology companies such as Microsoft, Apple, and others. Financials also underperformed but registered a positive return as concerns about sooner-than-expected Fed rate hikes in 2022 led to a flattening of the yield curve, which was a headwind on bank stocks. On a full-year basis, traditionally defensive sectors lagged, but logged substantially positive annual returns. Utilities and consumer staples were the worst performing sectors for the full year, as investors focused on companies with more positive exposure to higher inflation and economic growth.

Internationally, foreign markets saw modest gains in the fourth quarter as declines in emerging markets partially offset gains in developed markets. Emerging markets dropped in the fourth quarter in reaction to a stronger U.S. dollar. The Omicron variant also weighed on global economic growth estimates. Developed markets posted a positive return for the fourth quarter, although they badly underperformed the S&P 500. For the full year 2021, foreign markets registered solidly positive returns but handily underperformed the S&P 500 as only moderate gains in developed markets were offset by a modest annual decline in emerging markets.

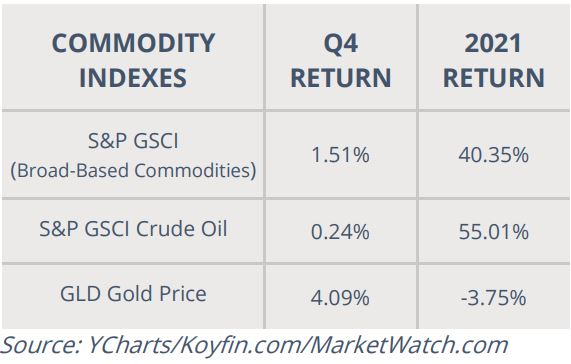

Commodities saw gains in the fourth quarter as both oil and gold logged positive returns. Oil rallied late in the quarter on fading concerns that Omicron would materially impact consumer demand for refined products around the globe. Gold saw a small gain in the fourth quarter thanks to continued high inflation readings, a decline in the U.S. dollar, and a general increase in market volatility following the Omicron surge. For 2021, commodities posted a large, positive return due to the significant gains in oil futures and other energy commodities which surged as the global economy reopened and demand increased amidst still-constrained supply thanks to a disciplined OPEC+ group. Gold saw a modestly negative return for 2021 as the increasing attractiveness of alternative investments, such as Bitcoin and other cryptocurrencies, combined with a stronger dollar to weigh on precious metals.

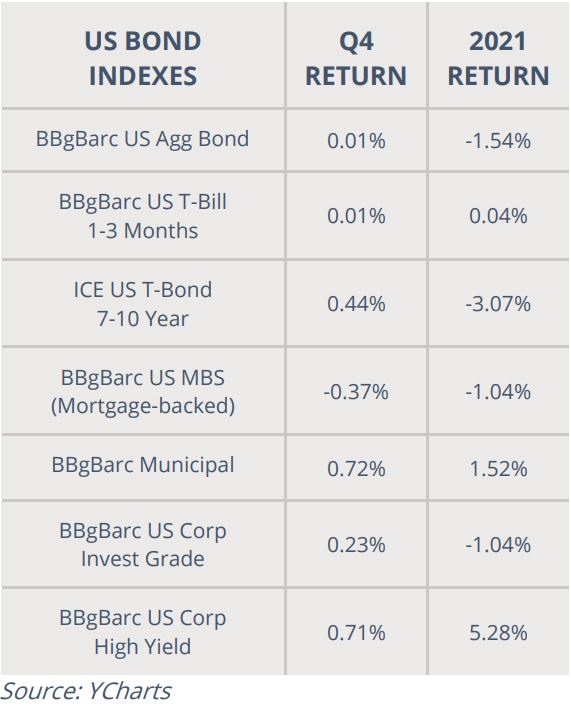

Switching to fixed income markets, the leading benchmark for bonds, Bloomberg Barclays US Aggregate Bond Index, experienced a fractionally positive return for the fourth quarter but declined for the full-year 2021, as the potential for sooner than-expected Fed rate hikes combined with still high inflation weighed on most bond classes.

Looking deeper into the fixed income markets, longer-duration bonds outperformed those with shorter durations in the fourth quarter, which reflected the market’s pricing in potentially sooner-than-expected Fed rate increases.

Higher-yielding, but lower-quality corporate bonds posted a positive return and outperformed on a full-year basis, as investors flocked to riskier debt amidst low rates, elevated inflation, and strong economic growth. Lower-yielding and safer investment-grade corporate debt underperformed in the fourth quarter and posted a negative return for 2021, reflecting bond investors’ search for higher yield, as well as concerns about inflation and rising rates.

Q1 and 2022 Market Outlook

Markets have exhibited very impressive resilience since the pandemic began and that remained the case throughout the fourth quarter and all of 2021. The strength of the U.S. economy and corporate America helped produce another year of substantially positive returns in stocks. That resilient nature will continue to support markets and the economy as we begin a new year. Like all years, 2022 presents numerous potential challenges to economic growth, corporate earnings, and market returns. This includes a reduction in global stimulus, stubbornly high inflation pressures, political uncertainty, and the ongoing pandemic.

Global central banks, led by the Federal Reserve, have already begun to reverse the historically accommodative policies that were enacted in response to the pandemic. The Fed expects to end its QE program by mid-March and increase interest rates three times in 2022. That transition to more normal monetary policy will likely create headwinds on the economy and potentially corporate earnings. U.S. stocks have historically performed well during the initial phases of a Fed rate hike campaign. We will closely monitor the impact of rate hikes on economic growth and the corporate earnings outlook as we move through 2022.

The Fed is more aggressively removing accommodative policies because inflation surged to 30-plus-year highs in 2021. Rising inflation did not have a negative impact on consumer spending or corporate earnings in 2021. But that risk remains as even optimists do not expect inflation to decline substantially in 2022. We will continue to monitor inflation closely to see if it becomes a negative influence on corporate margins and earnings, or consumer spending more broadly, which will result in a rise in market volatility.

Politics will also be a source of potential volatility in the first quarter of 2022 and beyond. Democrats failed to pass the Build Back Better social spending bill in 2021, but the process is not over. None of us should be surprised if that legislation passes in early 2022. From a market standpoint, investors will be focused on any potential tax increases that might reduce corporate profits or consumer spending. Given the current version of the bill, market-negative tax increases look unlikely, but the legislative process is unpredictable. We will continue to monitor the situation for any negative tax implications. There will be midterm elections in November, and as is usually the case, we can expect the run-up towards the midterms to cause at least temporary market volatility.

Finally, COVID is not over. The Omicron variant, which is currently spreading across the globe, thankfully does not result in nearly as many severe cases as previous COVID variants. It is, however, still impacting society and businesses via worker shortages and supply chain disruptions. As we look ahead to 2022, we must be prepared for more variants to impact the global economy. We will continue to watch for any sustainably negative impacts from COVID on the economy or markets.

While markets face numerous risks at the start of every new year, there remain multiple, powerful tailwinds on stocks and other risk assets. Corporate earnings remain incredibly strong and the performance of corporate America through the pandemic has been nothing short of amazing. Interest rates will likely rise in 2022, yet they remain very low and not close to levels that would historically be considered a headwind on economic activity. Personal savings remain high, unemployment remains low, and broadly speaking the U.S. economy is strong.

The outlook for 2022 remains decidedly positive despite the risks to the markets and economy that could result in historically typical volatility.

More broadly, one of the biggest takeaways from another unpredictable year in the markets is that a well-planned, long-term-focused and diversified financial plan can withstand virtually any market surprise and a related bout of volatility, including multiple COVID waves, inflation reaching 30-year highs, and the Federal Reserve removing historic accommodation.

At Krilogy, we understand the risks facing both the markets and the economy, and we are committed to helping you effectively navigate this still-challenging investment environment. Successful investing is a marathon, not a sprint, and even intense volatility is unlikely to alter a diversified approach set up to meet your long term investment goals.

Therefore, it’s critical for you to stay invested, remain patient, and stick to the plan. Your plan has been developed to establish a unique, personal allocation target based on your financial position, risk tolerance, and investment timeline.

The strong performance of markets in 2021 notwithstanding, we remain vigilant towards risks to portfolios and the economy, and we thank you for your ongoing confidence and trust. Please rest assured that our entire team will remain dedicated to helping you successfully navigate this market environment.

Important Disclosures

Information contained in this document is provided by an independent third party, Ned Davis Research. While believed to be accurate, Krilogy® has not independently confirmed each piece of information.

Investment Advisory Services offered through Krilogy®, an SEC Registered Investment Advisor. Please review Krilogy’s Form ADV 2A carefully prior to investing. All expressions of opinion are subject to change. This information is distributed for educational purposes only. It should not be construed as individualized advice or recommendations suitable for the reader.

Diversification does not eliminate the risk of market loss. Investments involve risk and unless otherwise stated, are not guaranteed. Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. Investment risks include loss of principal and fluctuating value. There is no guarantee an investing strategy will be successful. Past performance is not a guarantee of future results.