There is so much we do not know or understand about the coronavirus COVID-19 and its impact on the economy and financial markets.

- We don’t know the severity and spread of the pandemic

- We don’t know how long social-distancing measures will be in place

- We don’t know how these measures will impact the economy

- We don’t know if the policy response will be effective

The situation was summed up humbly by Gordon Dougan, a Cambridge University Professor who has spent his career researching vaccines and disease. In a recent blog post he said, “What is the value of experts like me? I likely know more about infection, epidemics and vaccines than most. I have studied epidemics across the world. I have made and designed vaccines. Do I know what will happen next with this epidemic? Which of the experts are right? The World Health Organization (WHO)? The politicians and their teams of scientists and modelers? In reality, we are all trying to take informed guesses.”

The outlook for the economy is equally cloudy. There is widespread disagreement among the nation’s top economists with regard to how long or how deep the economy is likely to sink. Statements like, “This is a healthcare crisis, not a financial crisis,” and “It’s going to get worse before it gets better,” provide little comfort or direction to investors who have watched $15 trillion of global stock market value simply evaporate in the span of just 5 weeks. (Source: Factset)

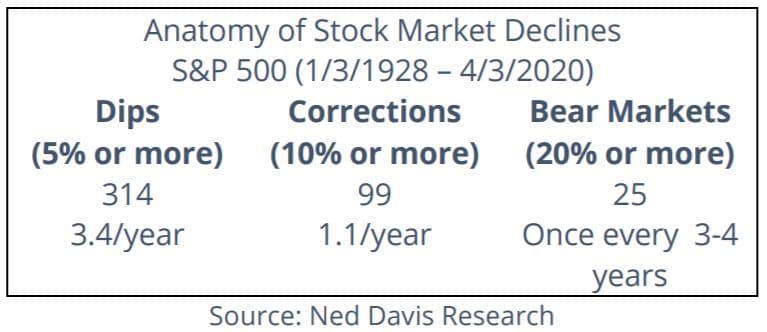

One thing is for certain – stocks have now entered a bear market, defined as a decline in stock prices (as measured by the S&P 500) of at least 20 percent.

While the reasons for bear markets are wide-ranging and varied, the principles for surviving a bear market are always the same. In fact, they are the rules one should follow if faced with a real bear in the woods. Consider this advice from survivalist Peter Kummerfeldt:

If a bear is approaching you, remain calm and stand your ground. Make no sudden moves. Do not yell, scream, kick or fight. Do not run. If the bear charges you, muster all of your courage and stay where you are. Never try to outrun a bear; it will only make matters worse. The injuries that occur are more a function of what the human does to resist than what the bear is capable of doing.” (Source: Peter Kummerfeldt)

Our advice is the same for investors. If you own quality investments and your portfolio is well-diversified, market declines are not a reason to abandon a well-thought-out investment plan.

Our advice for surviving a bear market:

- Recognize that stock market declines occur frequently and are a normal part of the investing process.

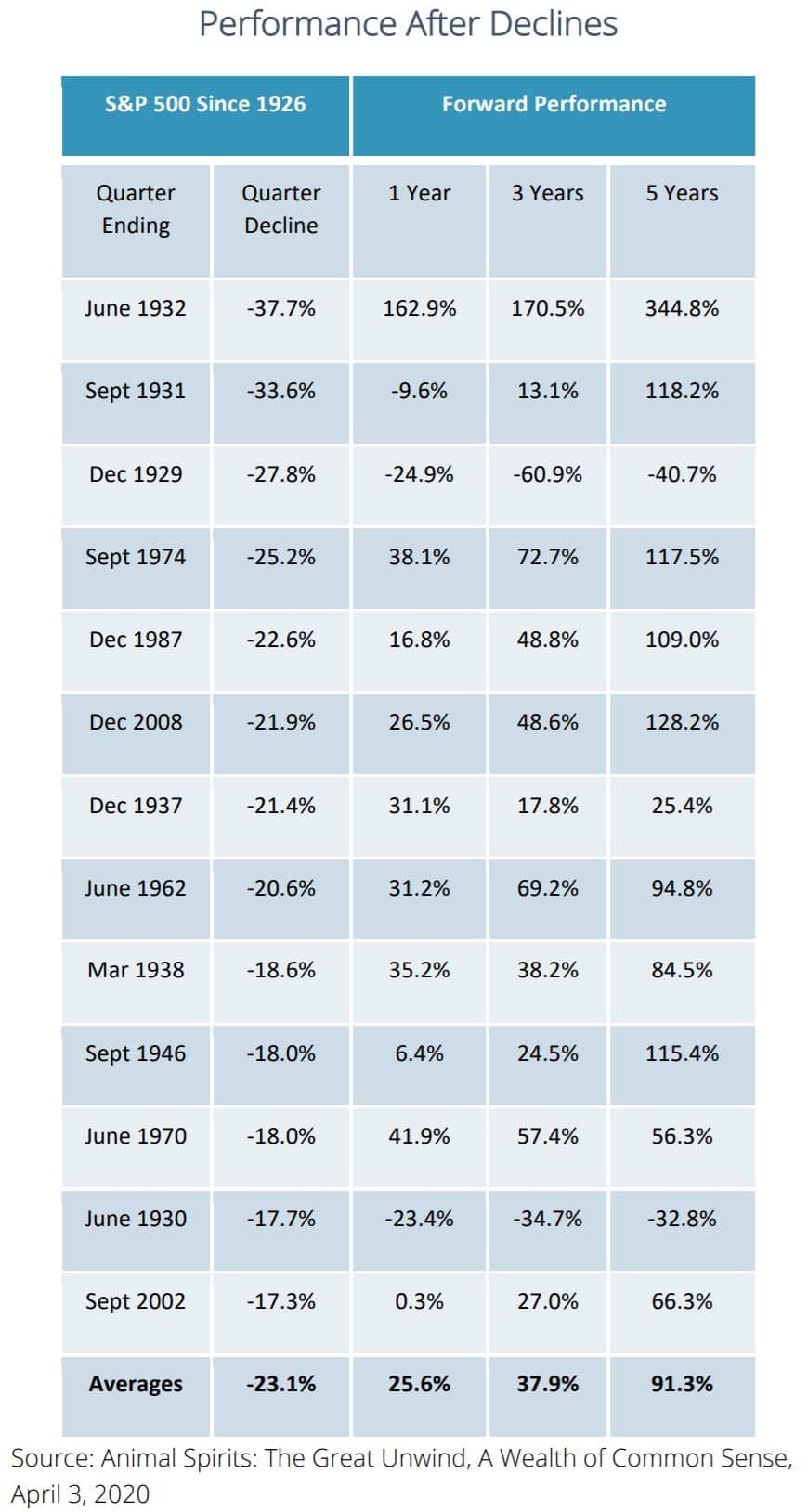

Market history suggests that declines are frequent. Most corrections aren’t serious, but bear markets have occurred every 3-4 years. - Understand that, historically, bear markets tend to be short and have always been followed by bull markets. In the past, these bull markets have more than made up for the losses incurred.

- Know that market declines can occur at any time for any reason. They are wholly unpredictable. Attempts to avoid market declines usually result in lower longterm returns because investors rarely get back in the market in time for the next upswing.

The chart below illustrates the risk of stepping to the sidelines during market declines. Missing out on just a few of the best days since 1980 would have significantly reduced an investor’s long-term returns. These “best days” often occur when the outlook is bleak.

Total return includes dividends. These calculations do not include any commissions or transaction fees that an investor may have incurred. These fees included would have a negative impact on the return. Source: Ned Davis Research. The S&P 500 is an unmanaged index and cannot be invested in directly. Past performance does not assure future results. This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

Will History Repeat?

A strong case can be made that the current crisis is much worse than anything any one of us has ever seen. That’s something all of us should keep in mind when comparisons are made to historical experience.

Of course, there are examples from history where the situation seemed equally as desperate.

How did Americans feel when a surprise attack at Pearl Harbor practically destroyed the Pacific Fleet?

How frightening was the Cuban Missile Crisis, which threatened to plunge the United States into a nuclear war with the Soviet Union?

How much confidence did investors have in 1982, when unemployment and inflation reached double-digits, and the stock market had gone nowhere for 16 years?

It’s easy for us today to look back at those experiences and say, “I knew we would get through it,” but any student of history knows that people back then were just as anxious as they are today.

Warren Buffett once said, “Investing is simple, but it’s not very easy.” This is one of those times when investing is not easy. It’s really uncomfortable to have money in the stock market right now, but the higher potential returns that stocks offer investors over the long run aren’t free of charge. Those higher potential returns only accrue to investors who have the patience, discipline and courage to stay the course during the most difficult of times.