Assessing the Market Crosscurrents

As we prepare to welcome the energy and activity of the Spring season, we also appear to be at an inflection point of energy and volatility within both the stock and bond markets.

We’ve recently experienced a period of high stock market complacency, thanks to historic fiscal and monetary liquidity. As we enter into a period of potential increased volatility, it’s appropriate to note that the average intra-year stock market decline has been 14.3% over the past 41 years.1 Mindfulness around these historic trends will help investors prepare for shifts that may be coming, and will help prevent making unsound, emotional investment decisions when volatility strikes again.

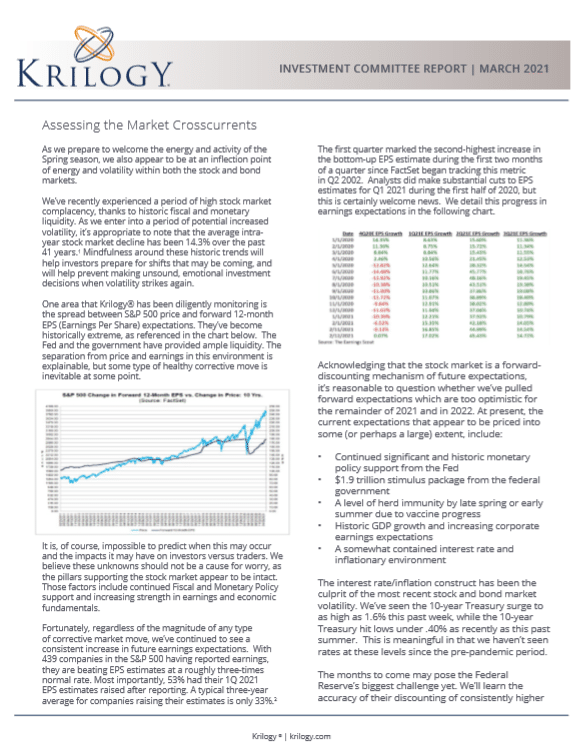

One area that Krilogy® has been diligently monitoring is the spread between S&P 500 price and forward 12-month EPS (Earnings Per Share) expectations. They’ve become historically extreme, as referenced in the chart below. The Fed and the government have provided ample liquidity. The separation from price and earnings in this environment is explainable, but some type of healthy corrective move is inevitable at some point.

It is, of course, impossible to predict when this may occur and the impacts it may have on investors versus traders. We believe these unknowns should not be a cause for worry, as the pillars supporting the stock market appear to be intact. Those factors include continued Fiscal and Monetary Policy support and increasing strength in earnings and economic fundamentals.

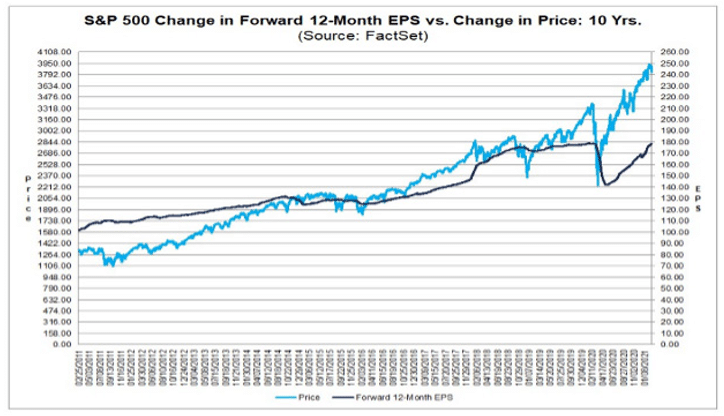

Fortunately, regardless of the magnitude of any type of corrective market move, we’ve continued to see a consistent increase in future earnings expectations. With 439 companies in the S&P 500 having reported earnings, they are beating EPS estimates at a roughly three-times normal rate. Most importantly, 53% had their 1Q 2021 EPS estimates raised after reporting. A typical three-year average for companies raising their estimates is only 33%.2

The first quarter marked the second-highest increase in the bottom-up EPS estimate during the first two months of a quarter since FactSet began tracking this metric in Q2 2002. Analysts did make substantial cuts to EPS estimates for Q1 2021 during the first half of 2020, but this is certainly welcome news. We detail this progress in earnings expectations in the following chart.

Acknowledging that the stock market is a forward-discounting mechanism of future expectations, it’s reasonable to question whether we’ve pulled forward expectations which are too optimistic for the remainder of 2021 and in 2022. At present, the current expectations that appear to be priced into some (or perhaps a large) extent, include:

- Continued significant and historic monetary policy support from the Fed

- $1.9 trillion stimulus package from the federal government

- A level of herd immunity by late spring or early summer due to vaccine progress

- Historic GDP growth and increasing corporate earnings expectations

- A somewhat contained interest rate and inflationary environment

The interest rate/inflation construct has been the culprit of the most recent stock and bond market volatility. We’ve seen the 10-year Treasury surge to as high as 1.6% this past week, while the 10-year Treasury hit lows under .40% as recently as this past summer. This is meaningful in that we haven’t seen rates at these levels since the pre-pandemic period.

The months to come may pose the Federal Reserve’s biggest challenge yet. We’ll learn the accuracy of their discounting of consistently higher rates versus their ability to use their referenced “tools” to control it. Despite Atlanta Fed’s Raphael Bostic’s expectation that the economy could recover more quickly than expected, he also indicated that he isn’t “worried about the move in yields.” This may be contrary to what the stock market has begun to feel, as the 10-year Treasury yield has also recently crossed the dividend yield on the S&P 500.3 This isn’t problematic in and of itself. As interest rates rise, it can become more challenging to justify higher equity market price-to-earnings multiples. Additionally, at some point, the safety and higher yield trade-off out of fixed income can again be more of a promising presence in the portfolio construction process than it has been in the rate-sunken pandemic era we’ve recently experienced. Until such a time comes, expect an increase in volatility and chatter around interest rate and inflationary pressures, but know that these things generally take time to unfold in a sustainable way. In the meantime, the fixed income markets and equity markets will attempt to embark on a normalization process following the uniqueness of the pandemic-induced recession and all the challenging circumstances around it.

At Krilogy, we continue to assess the economic and market landscape, while sticking to our portfolio construction process and on-going discipline that has proven successful over time. This process, in conjunction with our detailed and customized planning efforts, helps ensure continued accomplishment for those with whom we are blessed to work.

1 JP Morgan Guide to the Markets 1-31-21

2 The Earnings Scout 2-23-21

3 Reuters 2-25-21