On April 14, 1912, just before midnight, the British passenger liner RMS Titanic hit an iceberg. Within a few hours, the ship thought to be unsinkable lay at the bottom of the North Atlantic. About 710 people survived the experience, while at least 1,500 lost their lives. If you asked most people today what caused the Titanic disaster, they might simply answer, “An iceberg.”

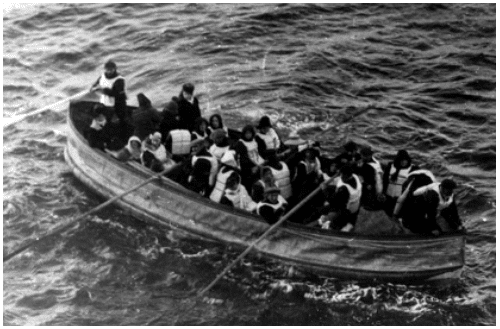

But the most disastrous part of the story – the terrible human tragedy – wasn’t caused by the failure to predict that the ship would strike an iceberg. It was the direct result of a failure to prepare. A century ago, the men responsible for building and operating Titanic did not admit even the possibility of the ship sinking. Titanic only had enough lifeboats to carry half of those aboard. The crew had not been trained adequately to carry out an evacuation. The officers did not know how many they could safely put into the lifeboats and launched many of them barely half-full. Even fully loaded, the 20 lifeboats could only accommodate 1,178 people, too few to save the 2,224 on board.

Today, the sudden outbreak of a global pandemic is something that few people predicted. This has been a sudden shock to investors, the figurative equivalent of hitting an iceberg.

If You Can’t Predict, You Must Prepare

Experience teaches us that market declines are something we always need to prepare for. The key to survival is not predicting ‘icebergs’, it’s having a sensible plan before you hit one. Here are the six most important ways to be prepared when disaster strikes:

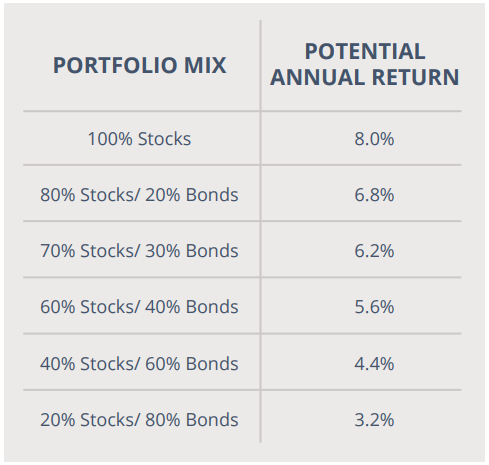

1. Establish an appropriate asset allocation

Knowing your risk tolerance is an essential first step in financial planning. Never have more money in the market than you are comfortable with. How do you find a proper mix for your assets? Some illustrations may help:

The table below shows potential annual return of different portfolios if the annual return on stocks and bonds averages 8 percent and 2 percent respectively over the long-term.

Past performance may not match future results. This is a hypothetical example based on the assumptions provided and is not representative of any specific investment. Results will vary. The hypothetical rates of return used do not reflect fee deductions and charges inherent to investing

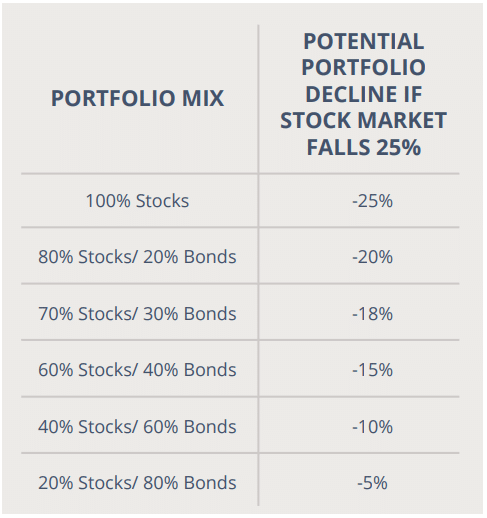

The next table shows the potential short-term loss these portfolios might experience if the stock market drops 25 percent in a single year:

Assumes bonds remain unchanged. Does not include dividends or interest. Not meant to represent any particular investment. Past performance may not match future results. This is a hypothetical example, not representative of any specific situation. Results will vary. The hypothetical rates of return used do not reflect fee deductions and charges inherent to investing.

While earning the highest returns over the long run might seem attractive at first, higher potential returns can only be earned over the long run by designing a portfolio that might have higher volatility in returns over the short run. Risk and return are two sides of the same coin. So, choose wisely and remember, the best asset allocation for you is one that you can stick with through good times and bad.

2. Maintain a consistent asset allocation through regular portfolio re-balancing

Unfortunately, it can be difficult to maintain an appropriate asset allocation because the value of your investments will fluctuate, so portfolios need to be rebalanced on a regular basis.

Imagine you selected an asset allocation of 50% stocks and 50% bonds. If 4 years go by during which stocks return an average of 8% a year and bonds 2%, you’ll find that your new asset mix is more like 56% stocks and 44% bonds. Over the course of a market cycle, you might find that you have too much of your portfolio in stocks after a big market rally, and too little in stocks after a significant decline. This could be the equivalent of “buy-high-and-sell-low”. Re-balancing involves regular adjustments to the portfolio to maintain a level of risk that is consistent with your long-term goals and risk tolerance.

3. Maintain a long-term perspective

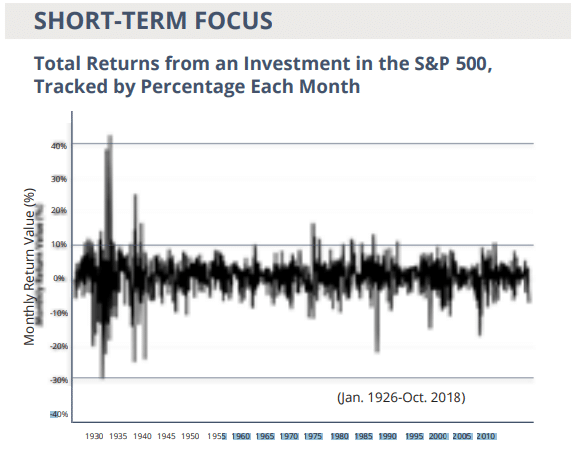

In the short term, the stock market seems unpredictable and random. The short-term stock market looks something like this:

Source: Ned Davis Research

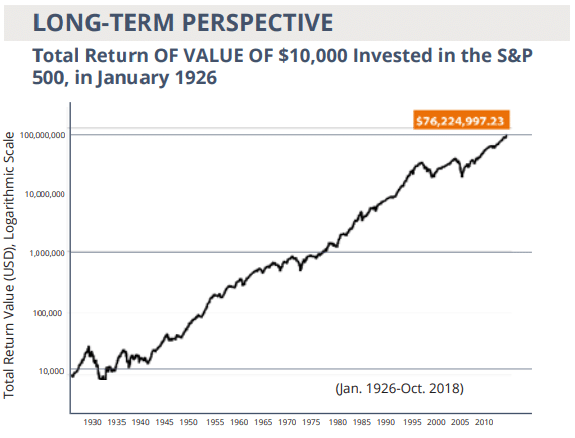

Over long periods of time, the stock market reflects the growth in the economy and corporate profits, and historically has looked something like this:

Source: Ned Davis Research

At times like the present, the stock market can feel very uncomfortable. But, in the words of Rudyard Kipling, “If you can keep your head when all about you are losing theirs, yours is the Earth and everything that’s in it.”

4. Diversify your portfolio

Your portfolio should be broadly diversified by security and asset class. Diversification cannot prevent a loss, but it should help dampen the volatility of your portfolio. If all your investments gain value at the same time, chances are, your portfolio is not properly diversified. Historically, a 50/50 mix of stocks and bonds has not suffered a negative return over any five-year rolling period in the past 69 years.

5. Focus on quality investments

Quality investments generally are those that have stood the test of time. Lower quality investments may not recover after difficult economic downturns. Like eggs, when they fall, they look something like this:

Quality investments are like tennis balls and can bounce back when the economy recovers.

6. Professional management

A study conducted by Dalbar, Inc. found that the average investor earned just 1.9 percent annually over the 20-year period ended December, 2018. We believe the three primary reasons for such disappointing performance are jumping in-and out of the market, poor diversification, and poor investment selection.

The principles listed in this report are the hallmark of professional investment management. An investment professional’s calm choices and a steady plan can be invaluable assets to help navigate difficult markets. Rigorous due diligence and research can help identify quality investments that will survive market turmoil. Portfolios that are professionally managed, monitored and rebalanced should have a better chance of weathering the storm.

The current crisis presents a difficult test for all investors, but we hope this report reassures you that we can get through it together.