Markets Complete a Historic Comeback in 2020

We hope this letter finds you safe and healthy. The most tumultuous year in recent memory ended on a high note for markets as the fourth quarter brought political and medical clarity. As a result, we experienced substantial market gains over the past three months which helped make 2020 a surprisingly strong year for market returns.

The fourth quarter began with substantial uncertainty across multiple fronts. Politically, President Trump contracted COVID-19 which underscored the prevalence of the virus and added further uncertainty to the looming election. After several months of relative stability in COVID-19 cases, infections began to rise rapidly across much of the United States as fall set in. Despite multiple rounds of negotiations, Congress and the White House were unable to compromise on a new economic stimulus bill. Uncertainty weighed on markets in October, and the S&P 500 finished the month with modest losses.

The first two weeks of November provided the clarity markets desired, which paved the way for substantial gains in stocks over the next month. First, the presidential election was executed successfully. As accusations of election fraud and legal challenges were brought by the Trump campaign, Joe Biden was widely accepted as the winner and President-elect. Furthermore, it appeared that Republicans would continue to hold a small majority in the Senate, potentially ensuring a market-friendly government for the next two years.

Less than a week after the election, Pfizer announced its COVID-19 vaccine was more than 90% effective at preventing infection, which was substantially better than initial estimates. Moderna then announced its COVID-19 vaccine was 95% effective. This double dose of positive news provided hope for investors regarding the pandemic, fueling a strong rally that lasted for the remainder of the month sending the S&P 500 to new all-time highs.

The consistency of the good news in November helped investors look past the surging number of new COVID-19 cases and the growing intensity of lockdown measures implemented across the country to slow the spread of the virus. By mid-December, New York City school closures, new dining restrictions, and a near state-wide “Safer at Home” order in California began to weigh on economic activity, creating a headwind on stocks.

The FDA soon approved the distribution of both the Pfizer and Moderna vaccines. This reminded investors that the end of the pandemic may be merely months away. The surging number of coronavirus cases and widespread economic lockdowns did not cause a material decline in stocks.

Finally, Congress approved a $900 billion stimulus bill that would help support the economy as it continues to recover from the pandemic. The news helped the S&P 500 hit a new all-time high just before year-end.

Markets ended a historic year on a high note, as federal economic support, record-breaking vaccine development, and a resilient corporate America helped offset the worst global pandemic in more than a century.

4th Quarter and Full-Year 2020 Performance Review

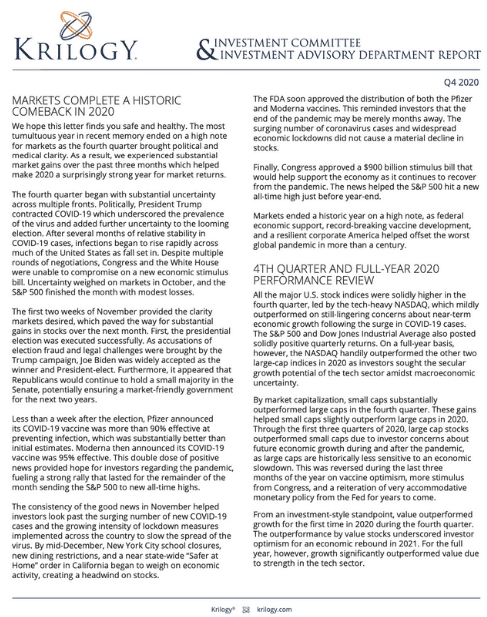

All the major U.S. stock indices were solidly higher in the fourth quarter, led by the tech-heavy NASDAQ, which mildly outperformed on still-lingering concerns about near-term economic growth following the surge in COVID-19 cases. The S&P 500 and Dow Jones Industrial Average also posted solidly positive quarterly returns. On a full-year basis, however, the NASDAQ handily outperformed the other two large-cap indices in 2020 as investors sought the secular growth potential of the tech sector amidst macroeconomic uncertainty.

By market capitalization, small caps substantially outperformed large caps in the fourth quarter. These gains helped small caps slightly outperform large caps in 2020. Through the first three quarters of 2020, large cap stocks outperformed small caps due to investor concerns about future economic growth during and after the pandemic, as large caps are historically less sensitive to an economic slowdown. This was reversed during the last three months of the year on vaccine optimism, more stimulus from Congress, and a reiteration of very accommodative monetary policy from the Fed for years to come.

From an investment-style standpoint, value outperformed growth for the first time in 2020 during the fourth quarter. The outperformance by value stocks underscored investor optimism for an economic rebound in 2021. For the full year, however, growth significantly outperformed value due to strength in the tech sector.

On a sector level, all 11 S&P 500 sectors finished the fourth quarter with positive returns. Cyclical sectors, including energy, financials, industrials, and materials led markets higher over the past three months. This was a reversal from their underperformance throughout the first three quarters of 2020. The familiar influences of vaccine optimism and stimulus hopes were the primary drivers of the cyclical outperformance in the fourth quarter. For 2020, however, the tech sector was, by far, the best-performing sector in the market as investors flocked to tech stocks that were viewed as beneficiaries of numerous pandemic-related changes in behavior, such as online shopping and working from home.

Sector laggards in the fourth quarter were the traditionally defensive market sectors. Utilities, real estate, and consumer staples underperformed the S&P 500 on the prospects of a strong economic rebound. On a full-year basis, energy was the biggest laggard amid the threat that slowing global growth might result in a historic glut in oil inventories worldwide. Energy shares finished 2020 with sizable losses, despite the large rebound in the fourth quarter.

Looking internationally, foreign markets saw positive returns in the fourth quarter. This was driven by several factors, including the European Central Bank increasing its pandemic-related QE program, Brexit clarity, and general optimism that vaccine distribution would result in a future rebound in global economic growth. Emerging markets outperformed foreign developed markets and the S&P 500 in the fourth quarter as the result of a substantially weaker U.S. dollar and an improving outlook for the global economy. For the full year 2020, foreign markets registered solidly positive returns, with emerging markets outperforming due to the aforementioned decline in the U.S. dollar. However, foreign developed markets underperformed the S&P 500 last year.

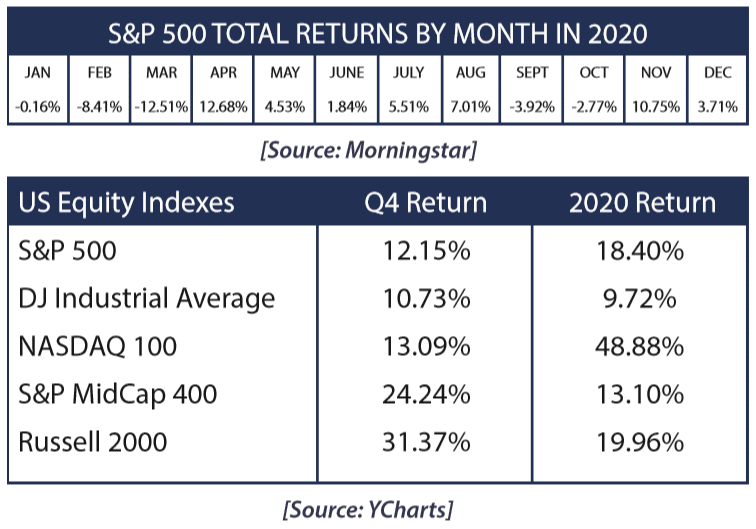

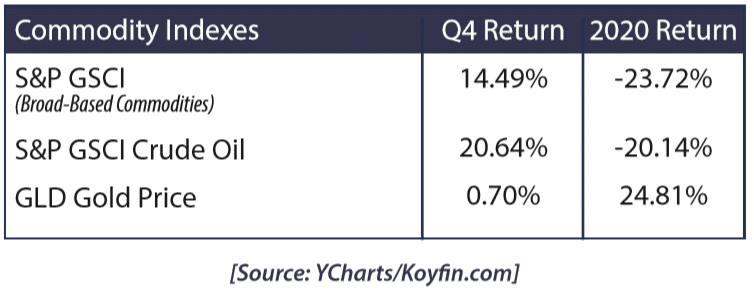

Commodities enjoyed strong gains in the fourth quarter, led higher by a rally in oil. Gold, however, changed little over the past three months. Oil prices rose in the fourth quarter thanks to optimism towards a global economic rebound in early 2021 following the vaccine announcements, combined with continued production discipline by “OPEC+.” Gold, meanwhile, spent much of the fourth quarter in negative territory as investors rotated out of the safe-haven metal and into more risky assets following the positive vaccine developments, election results, and stimulus bill passage.

For 2020, however, commodities posted a substantially negative return largely due to a significant and historic decline in oil futures prices, which fell into negative territory for the first time ever during the month of April, as the pandemic-related lockdowns crippled demand for refined products. Gold ended the year with a positive return, with the weaker dollar and firming inflation expectations buoying the precious metal.

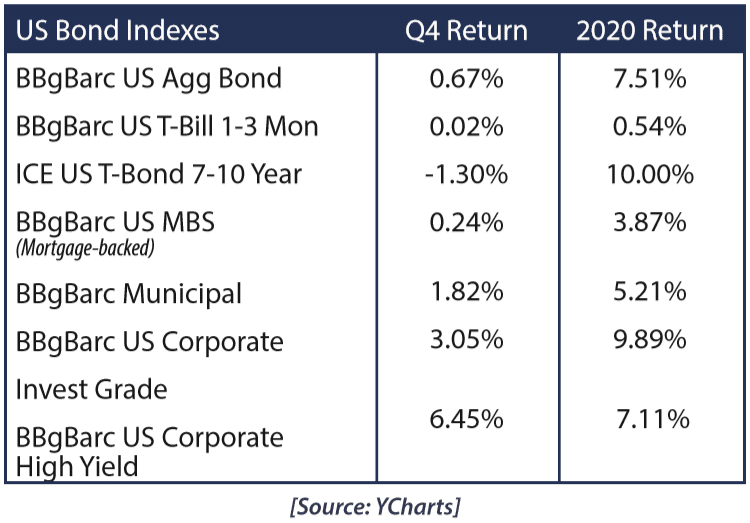

Switching to fixed income markets, total returns for most bond classes were positive in the fourth quarter. The leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) experienced slightly positive returns for the ninth straight quarter.

Looking deeper into the fixed income markets, longer-duration bonds underperformed those with shorter durations in the fourth quarter, which was a reversal from most of 2020. This reflected the market’s response to the Fed’s promise of low rates, potentially for years to come.

Confirming improved sentiment in the fourth quarter, primarily driven by vaccine distribution and stimulus, corporate bonds saw solidly positive returns as high-yield debt outperformed investment-grade debt. The outperformance of lower quality but higher yielding corporate debt also underscored rising optimism for an economic rebound in 2021 given the vaccine and stimulus, and a positive view of future corporate earnings.

1st Quarter and 2021 Market Outlook

As we reflect on 2020 and start working through 2021, we first want to acknowledge the hardship that so many have endured over the past 12 months. We sincerely hope that physical, emotional, and financial burdens are eased in 2021 and beyond.

There are many reasons for optimism in this new investing year. We are pleased to report that, from a macroeconomic standpoint, the outlook for 2021 is materially more positive than it was for the majority of 2020.

First, the Fed is continuing its historic QE program and will keep rates low for years to come. We anticipate this will continue to help support asset markets broadly. Meanwhile, Congress has finally agreed on another historically large fiscal stimulus bill which will help the economy weather the ongoing COVID-19 pandemic and related economic lockdowns.

Politically, neither party has a material majority in either house of Congress. As such, markets are not concerned about policy risks to the economy (substantial tax increases, excessive regulation, or major initiatives like healthcare reform). Finally, corporate America has once again demonstrated itself to be both resourceful and resilient. While some industries (airlines, cruise lines, hotels) face a long road to recovery, many American companies have exited 2020 in a strong financial position. The fundamental outlook for stocks is positive as we enter 2021.

2020 has taught us all that nothing is guaranteed, and we must be prepared for the unexpected.

Unemployment remains historically high (still well above levels we saw at the depths of the Great Recession). Many of those unemployed workers could return to work once the pandemic begins to recede, yet it is unclear how many small businesses will have survived to hire them back.

Additionally, as the economy begins to normalize, the appetite for more stimulus from Washington will diminish. It remains unclear just how quickly we can expect economic growth to return to pre-COVID levels. Regarding stimulus, investors must remain wary of the negative consequences of the ballooning federal debt and budget deficits. We will continue to closely monitor inflation and interest rates as they are among the most sensitive instruments to increased deficits and Federal debt. Finally, stock valuations are at multi-year highs.

None of these risks, by themselves, offset the positive factors helping the economy and markets as we begin a new year.

One of the biggest takeaways from this historically volatile year in the markets is that a well-planned, long-term-focused and diversified financial plan can withstand virtually any market surprise and a related bout of volatility, including the worst pandemic in 100 years.

At Krilogy®, we understand the risks facing both the markets and the economy and are committed to helping you effectively navigate this still-challenging investment environment. Successful investing is a marathon, not a sprint. Even the intense volatility we experienced in the first half of 2020 is unlikely to alter a diversified approach designed to meet your long-term investment goals. It is critical for you to stay invested, remain patient, and stick to your plan.

The resilient nature of markets in 2020 notwithstanding, we remain vigilant towards risks to portfolios and the economy. Please rest assured that your entire Krilogy® Team remains dedicated to guiding you through this market environment.

Thank you for your ongoing confidence and trust.