Federal Reserve Fed Funds Rate Decision 9-17-15

Yesterday’s FOMC meeting has been one of the most widely anticipated economic events in several years. We had seen rampant debate as to whether the FOMC would hold the Fed Funds rate unchanged at 0.0% – 0.25% or whether it would initiate the first rate hike since moving to its zero interest rate policy in December of 2008. Going into the Fed announcement yesterday, according to Bloomberg estimates, almost half (48%) of economists surveyed thought the Fed would raise rates in September. However, implied probabilities from the futures markets showed the chance of a rate increase at about 28% (as of 9/14/15). Therefore, it’s fair to say the market got what it expected, but not what it wanted.

The Fed’s statement on domestic growth and inflation sounded very similar to commentary in past statements. However, the statement now appears much more nervous about international economic conditions. This additional wrinkle is difficult to quantify and measure, and thus creates anxiety in the financial markets. Specifically, in one comment the Fed spoke of how “Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.” To this point, one could argue that we have seen deflationary signs rear its ugly head in some capacity. In 189 countries for which data is available, median inflation for 2015 is running just below 2%, which is the level in which most central bankers define price stability. Fortunately, we are, and have been, experiencing interest rate policy easing by most Global Central Banks, as all of the following have had their last interest rate move in the downward direction (Japan, Eurozone, United Kingdom, Canada, China, India, Russia, South Korea).

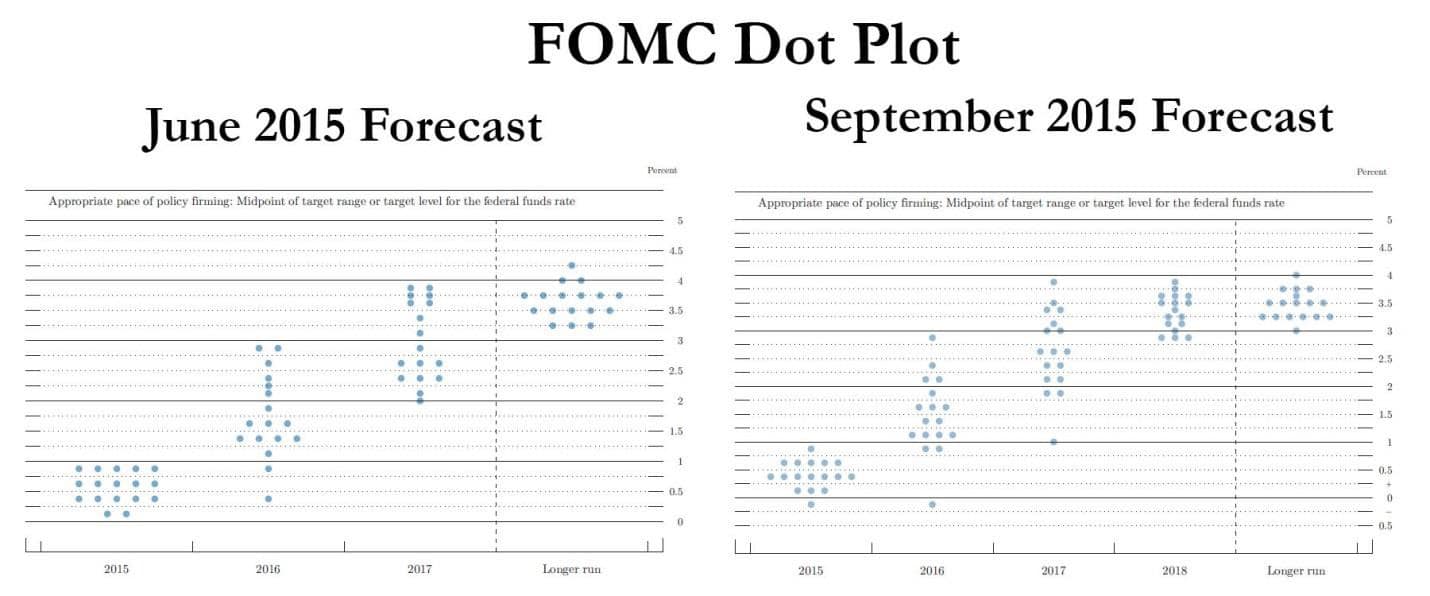

The Fed’s dot plots (see below), which show how FOMC members see the likely path of rate hikes, were lowered although by no more than expected. The takeaway here is that rates may stay lower for longer, but that a gradual uptick over time is a healthy sign. Lower rates for longer certainly hasn’t hurt the equity markets in recent years.

Going forward, with low inflation or even deflationary threats, the financial markets will have to adjust, and rely, on economic growth fundamentals or look for stimulus elsewhere. The U.S. economy likely will continue to be supported by consumer spending. This appears promising as we’ve seen robust housing, strong auto sales, and a decline in energy prices, which will act as its own form of stimulus for consumers. In just the last year, prices at the pump in Missouri, on average, have gone from over $3.20 a gallon, to around $2.00. A savings I think all appreciate.

So what does all of this mean and why does it matter? At the end of the day, we are only talking about a 0.25% increase in the cost of interbank funds (used to meet reserve requirements) in a banking system that has excess liquidity to the tune of about $2.6 trillion. This hardly represents any significant tightening of monetary conditions, but is more of a mindset shift from years of QE and very loose monetary policy. It’s hard to imagine that demand for credit in the economy will be impacted by an increase of one fourth of one percent in the Fed Funds rate. Whenever the first hike occurs, that change can only be described as “less accommodative” policy and certainly not restrictive.

The ideal policy decision (from the perspective of the stock market) was a rate hike with “dovish” commentary from the Fed, but obviously that didn’t happen. Therefore, yesterday’s lack of Fed action is not horrible but certainly not ideal. The stock market knows an eventual hike is necessary and signals some form of economic strength. The uncertainty pertaining to when the eventual first hike in 7 years comes is unsettling and likely leads to more volatility. A raise yesterday would have signified that the labor market and outlook for economic activity is solid enough to withstand any tertiary global concerns or pressures and we just didn’t get that clearly defined, distinct message. Many retail investors now ask the question, what do I now do from a strategy perspective?

The answer is likely nothing, assuming you have, both an investment process for managing through this volatility, such as our Dynamic Rebalancing Process, and a portfolio of assets that is aligned with your financial plan’s objectives and appropriate for the overall level of risk aligned with your plan. At minimum, your portfolio should be composed of assets that are correlated to the U.S. and global equity markets, assets that are negatively correlated to equites, and an allocation that is non-correlated to the equity markets. Many may ask, I thought bonds were not the ideal investment to own right now?

The financial media may have us believe that bonds have no business in a portfolio where interest rates are “expected” to rise, but let’s be honest with ourselves here. In 2014 when the 10 year Treasury began the year around 3%, virtually every strategist expected/predicted a continued rise in what had been a 3% ten year treasury at the time. The ten year treasury ended the year around 2%. This example underscores the need for diversification not only within equity and non-correlated investments (investments that perform irrespective of how stocks and bonds perform), but within the fixed income category, as well. Generally speaking, rising interest rates can have a negative impact on bond investing, but we’re constantly reminded that not all bonds are created equal. Just in the last year alone, we’ve seen an approximate 6.5% spread in return between a long-term government bond and a long-term corporate bond. There is simply no such thing as a “given” in the financial markets and the art of disciplined investing with an on-going process for managing risk and volatility is absolutely critical. The recessions of 2008-2009 and in 2000-2002, reminds us that we hate to lose way more than we love to win, when it comes to our investment assets that we’ve spent too much time and energy accumulating.