The American Rescue Plan Act of 2021 (ARPA) was enacted as part of President Biden’s plan to help facilitate the United States’ recovery from the COVID-19 pandemic. The bill was signed into law March 11, 2021. The legislation includes the expansion of the Child Tax Credit (CTC). The

expansion only applies for the 2021 tax year and is based on your 2020 adjusted gross income. Please note, this credit may need to be paid back to the IRS subject to your 2021 income, and the details are as follows:

Credit amount increase:

- Increases the credit from $2,000 to $3,000 for qualifying children from ages 6 through 17. Additionally, the ARPA added 17-year-olds under the definition of a qualifying child. The credit also includes an extra $600 for children who have not attained age 6 by the end of 2021 making the credit amount $3,600.

Advanced payments:

- A portion of this credit will be payable in advance for 2021. The IRS plans to issue these payments as early as July 15th.

Refundable portion:

- The refundable portion of the credit increases from $1,400 per child to the maximum credit available for each child. Refundable tax credits are payable to the taxpayer even if the tax liability is zero.

Income phaseout rules:

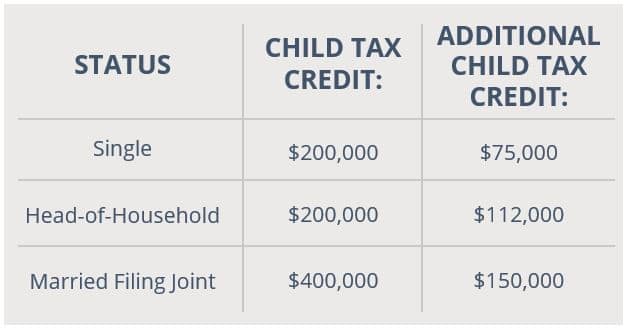

- The extra $1,000 (or $1,600 if dependent is >6) credit amount is subject to a different set of phaseout rules than the original child tax credit. However, if you are not eligible for the additional child tax credit due to the phaseout limitations, you are still eligible for the previous child tax credit amounts. Refer to the table below to see where the two sets of phaseout limitations begin:

Child Tax Credit (CTC) Two Phaseouts:

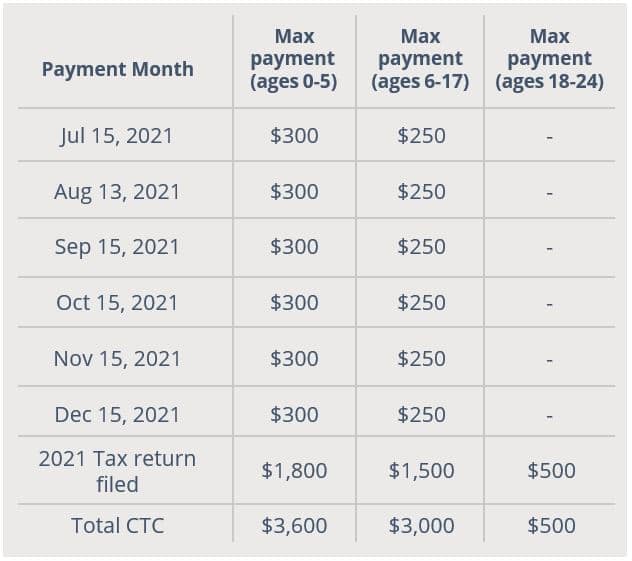

A portion of this credit is payable in advance for 2021. The IRS has already started sending letters to taxpayers regarding their eligibility to receive monthly CTC payments. Eligible taxpayers will begin receiving payments in advance through direct deposit or check. The IRS plans on issuing the advance CTC payments on July 15, August 13, September 15, October 15, November 15, and December 15. The breakout of the payment timeline is included in the graph:

Be advised, the IRS will automatically enroll taxpayers to receive advanced payments unless you opt-out. For taxpayers that wish to opt-out from receiving advanced payments so they can utilize the total credit in 2022, please visit the IRS website listed below:

https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021

Krilogy Tax Services serves primarily Krilogy clients who seek additional tax advice and guidance, along with tax preparation of client’s annual tax returns. Creating and managing a client’s financial picture involves a seamless connection between financial advising and tax planning. This comprehensive approach and commitment to client service is the foundation of Krilogy.

Important Disclosures

Krilogy® does not provide tax and legal advice. Krilogy® is affiliated with Krilogy Tax Services, LLC through certain common ownership interest by Krilogy partners. Krilogy Tax Services provides tax planning and preparation services for an additional cost to Krilogy Financial clients.